We have described a market for a particular kind of loan, but more generally we know that there are all kinds of different ways in which credit is offered in an economy. Households borrow from banks to buy houses or cars. Households and firms make purchases using credit cards. Firms borrow from financial institutions to buy new equipment. The government borrows to finance its spending, and so on. There is a very large number of credit markets in the economy, each offering a different kind of credit, and each with its own equilibrium interest rate.

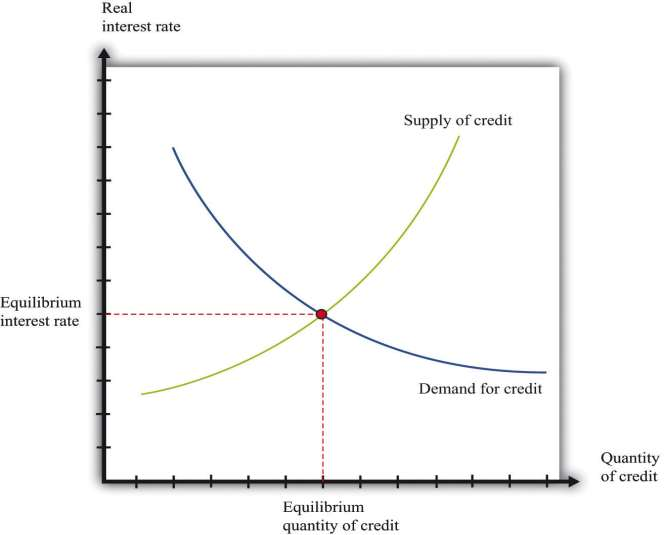

These different credit markets are linked because most households and firms buy or sell in more than one market. Financial institutions in particular trade in large numbers of different credit markets. For much of what we do in macroeconomics, however, the distinctions among different kinds of credit are not critical, and it is sufficient to imagine a single aggregate credit market and a single real interest rate. [***In Chapter 9 "Money: A User’s Guide", we look in more detail at the different kinds of credit—and the associated different interest rates—that we see in an economy. We also investigate in more detail how these markets are linked together.***] ***Figure 4.9 "The Aggregate Credit Market" shows the credit market for an entire economy. This is the market where all the savers in the economy bring funds to financial intermediaries, who then lend those funds to firms, households, and governments. The supply of credit increases as the interest rate increases. As the interest rate increases, other things being equal, households will generally save more and thus supply more to the credit market. The quantity of credit demanded decreases as the interest rate increases. When it is expensive to borrow, households and firms will borrow less.

Toolkit: Section 16.4 "The Credit (Loan) Market (Macro)"

The credit market brings together suppliers of credit, such as households who are saving, and demanders of credit, such as businesses and households who need to borrow. The real interest rate is the price that brings demand and supply into balance. At the equilibrium interest rate, the amount of credit supplied and the amount of credit demanded are equal.

Two of the most important players in the credit market are the government and the monetary authority. If the US federal government borrows more, this shifts the demand for credit outward and increases the interest rate. (Notice that the government is a big player in this market, so its actions affect the interest rate.) The monetary authority, meanwhile, buys and sells in credit markets to influence interest rates in the economy. [***We study the actions of the Federal Reserve and other monetary authorities in Chapter 10 "Understanding the Fed".***] In the 2008 crisis, the Federal Reserve Bank, which is the monetary authority in the United States, took many actions to increase the supply of credit and ease the problems in the credit market.

- 1599 reads