At the height of the financial crisis of 2008, credit became much more expensive—that is, interest rates increased. Why? As housing prices collapsed in the United States and elsewhere, a substantial number of mortgage loans became nonperforming. This means that borrowers were unable or unwilling to repay these loans and defaulted on them instead. In addition, because banks had sold and resold some of these mortgage loans, it was hard to identify which loans would be repaid and which would not. Some financial institutions that were holding a lot of bad loans went bankrupt, and others were in danger of going under as well.

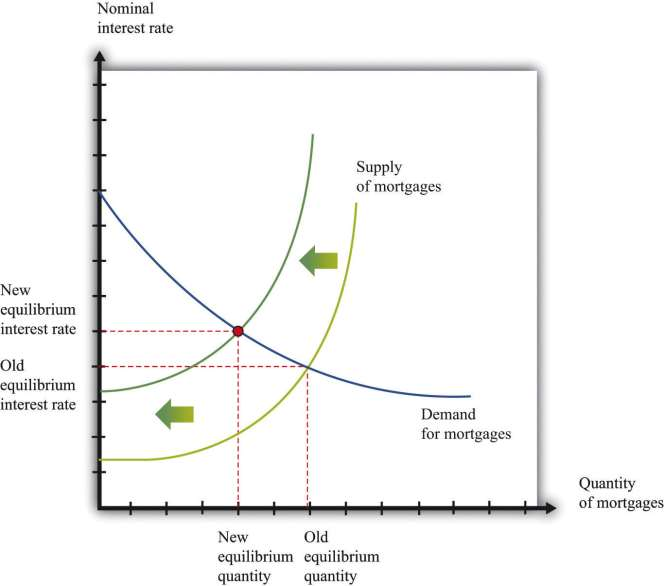

As a consequence, lenders became much more cautious about the types of loans they made— not only in mortgage markets but also throughout the economy. They were more careful about evaluating the likelihood that borrowers would repay their loans. This led to a reduction in the market supply of credit. The reduced supply of loans in the mortgage market was particularly acute. This appears as a leftward shift of the supply curve in ***Figure 4.8 "A Reduction in Supply in the Mortgage Market". Nominal interest rates increased, and the quantity of mortgages extended decreased. (The full story of what happened in credit markets is more complicated because central banks around the world also took actions to offset these changes and keep interest rates low.)

- 1655 reads