In the memo with which we opened the chapter, the Federal Open Market Committee (FOMC) decided to increase the target federal funds rate to 2.5 percent. But what exactly does this mean, and how did the Fed accomplish it? The federal funds rate is the interest rate in a particular market—the market where banks make overnight loans to each other. Overnight loans, as the name suggests, are assets that have a very short time to maturity (one day). The interest rate on these loans is therefore one of the “shortest” interest rates in the economy, which is why it is targeted by the Fed. The interest rate is so named because the loans are made using the funds that banks have available in their accounts at the Federal Reserve.

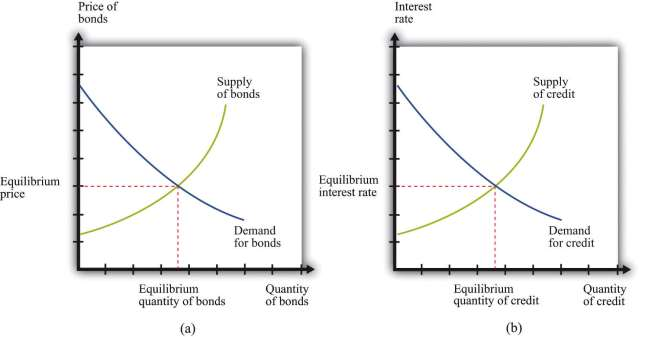

The Federal Reserve does not participate directly in this market. It influences the federal funds rate by buying and selling in a different market—the market for short-term government debt. These purchases and sales are called open-market operations. [***Section 14 of the Federal Reserve Act describes open-market operations.***]Let us examine how this works. The effect of open-market operations can be seen in the market for government debt. Part (a) of Figure 10.18 "The Market for Government Bonds"shows the supply and demand of this asset. The horizontal axis shows the quantity of assets (think of this as the amount traded on a given day), and the vertical axis shows the price of those assets. The participants in this market are financial institutions and others who hold, or want to hold, bonds as part of their portfolio of assets. Current owners will be willing to sell bonds if their price is sufficiently high. Conversely, if the price of bonds decreases, more people will want to purchase them. The same institution could be either a supplier or a demander, depending on the price. It is perfectly possible that a financial institution would want to buy bonds if their price were low and sell them if their price were high.

(a) The price of bonds is determined by supply and demand. (b) These same transactions are represented in a credit market, which is another way of looking at exactly the same market.

Part (b) of ***Figure 10.18 "The Market for Government Bonds" shows the equivalent representation of this as a credit market. When the Fed buys bonds, it is making a loan. When the government or private investors sell bonds to the Fed, they are borrowing from the Fed. The crossing of the supply and demand curves tells us the equilibrium price of government bonds. It also tells us how many bonds changed hands that day, but our interest here is in what is happening to prices.

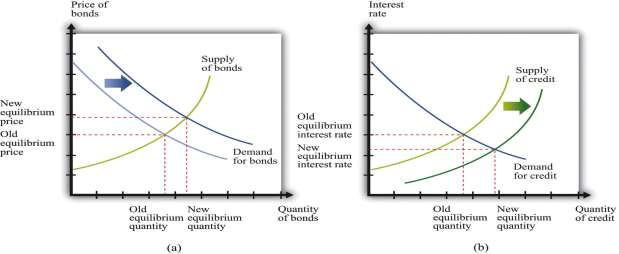

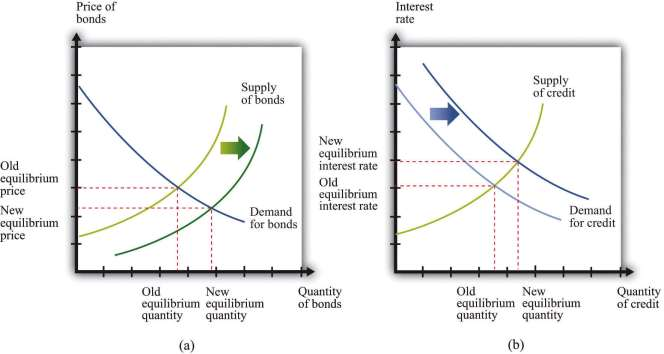

Now suppose the Federal Reserve steps into this market and buys some government bonds. This increases the demand for bonds, so the price of bonds will increase. This is shown in part (a) of ***Figure 10.19 "Intervention by the Federal Reserve". Part (b) of ***Figure 10.19 "Intervention by the Federal Reserve" shows the same action viewed through the lens of a credit market. Conversely, if the Fed decides to sell some of its stock of government bonds, the supply of bonds will shift out, and the price of bonds will decrease (see ***Figure 10.20 "Intervention by the Federal Reserve").

When the Federal Reserve conducts an expansionary open-market operation, it purchases bonds (a) or, equivalently, supplies more credit (b). The price of bonds increases, or, equivalently, the interest rate decreases.

When the Federal Reserve conducts a contractionary open-market operation, it sells bonds (a) or, equivalently, demands more credit (b). The price of bonds decreases, or, equivalently, the interest rate increases.

Thus the Federal Reserve, by buying or selling government bonds in this market, has the ability to influence the price of bonds. This means that it can affect the interest rate on those bonds.

From this relationship, we know the following:

- If the Fed buys bonds, then the price of bonds increases, and interest rates decrease.

- If the Fed sells bonds, then the price of bonds decreases, and interest rates increase.

The Fed’s actions in this market have an effect on interest rates in other markets, as banks and other financial institutions adjust their portfolios in response to the changing interest rate on government bonds. The Fed calibrates its buying and selling to try to achieve its target interest rate in the federal funds market.

- 1519 reads