A credit market (or loan market) is a market in which credit is extended by lenders to borrowers. These credit arrangements, also called loans, are a specific kind of contract. A simple credit contract specifies three things: (1) the amount being borrowed, (2) the date(s) at which repayment must be made, and (3) the amount that must be repaid. [***Of course, since credit contracts are legal documents, lots of other details will be written into the contract as well. Here we focus on the most important features of the contract.***]

To be specific, suppose you go to your bank to inquire about a loan for $1,000, to be repaid in one year. In this case the lender—the bank—is a supplier of credit, and the borrower—you—is a demander of credit. The higher is the repayment amount, the more attractive this loan contract will look to the bank. Conversely, the lower is the repayment amount, the more attractive this loan contract looks to you. The relationship between the current price and the future repayment can be summarized in a single number, known as the nominal interest rate.

Toolkit: Section 16.4 "The Credit (Loan) Market (Macro)"

The nominal interest rate is the number of additional dollars that must be repaid for every dollar that is borrowed. It is generally specified in annual terms; that is, it is the amount that must be paid per year.

For the one-year loan we are considering,

****FORMULA 6

For example, suppose the repayment amount is $1,050. Then the left-hand side of this expression is 1,050/1,000 = 1.05. It follows that the nominal interest rate is 0.05, or 5 percent.

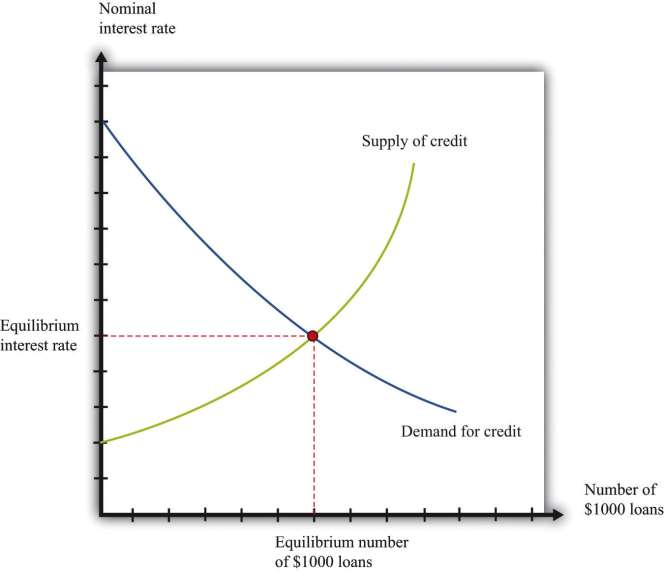

Financial markets are typically good examples of competitive markets. Loans are homogeneous, and there are potentially many buyers and sellers. So if we imagine that there are lots of banks that might be willing to supply credit, and lots of people like you who might demand credit, then we could draw supply and demand curves as in Figure 4.7 "A Market for $1,000 Loans". In this case, the units on the quantity axis are one-year $1,000 loans. The price on the vertical axis is the interest rate, which tells us the amount of the repayment per dollar loaned. The higher the repayment is, the more willing are banks to supply credit, so the supply curve slopes upward. The higher the repayment, the less willing are people to take out these loans, and so the demand curve slopes downward. If the repayment price were acceptable to you, you would “buy” one of these $1,000 loans. The equilibrium nominal interest rate is shown at the crossing of supply and demand.

- 2043 reads