Under ULPA-1985 and its predecessors, a limited partner who exercised any significant control would incur liability like a general partner as to third parties who believed she was one (the “control rule”). However, among the things a limited partner could do that would not risk the loss of insulation from personal liability were these “safe harbors”:

- Acting as an agent, employee, or contractor for the firm; or being an officer, director, or shareholder of a corporate general partner

- Consulting with the general partner of the firm

- Requesting or attending a meeting of partners

- Being a surety for the firm

- Voting on amendments to the agreement, on dissolution or winding up the partnership, on loans to the partnership, on a change in its nature of business, on removing or admitting a general or limited partner

However, see Limited Liability Limited Partnerships for how this “control rule” has been abolished under ULPA-2001.

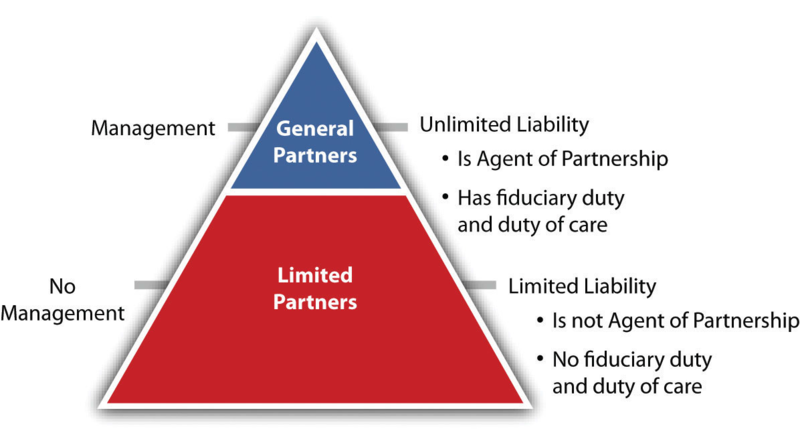

General partners owe fiduciary duties to other general partners, the firm, and the limited partners; limited partners who do not exercise control do not owe fiduciary duties. See Figure 24.1.

The partnership agreement may specify which general or limited partners have the right to vote on any matter, but if the agreement grants limited partners voting rights beyond the “safe harbor,” a court may abolish that partner’s limited liability.

- 2129 reads