When the assets of a company are purchased, the selling company itself may or may not go out of existence. By contrast, in a merger, the acquired company goes out of existence by being absorbed into the acquiring company. In the example in Merger , Flying Truck would merge into BCT, resulting in Flying Truckman losing its existence. The acquiring company receives all of the acquired company’s assets, including physical property and intangible property such as contracts and goodwill. The acquiring company also assumes all debts of the acquired company.

A merger begins when two or more corporations negotiate an agreement outlining the specifics of a merger, such as which corporation survives and the identities of management personnel. There are two main types of merger: a cash merger and a noncash merger. In a cash merger, the shareholders of the disappearing corporation surrender their shares for cash. These shareholders retain no interest in the surviving corporation, having been bought out. This is often called a freeze-out merger, since the shareholders of the disappearing corporation are frozen out of an interest in the surviving corporation.

In a noncash merger, the shareholders of the disappearing corporation retain an interest in the surviving corporation. The shareholders of the disappearing corporation trade their shares for shares in the surviving corporation; thus they retain an interest in the surviving corporation when they become shareholders of that surviving corporation.

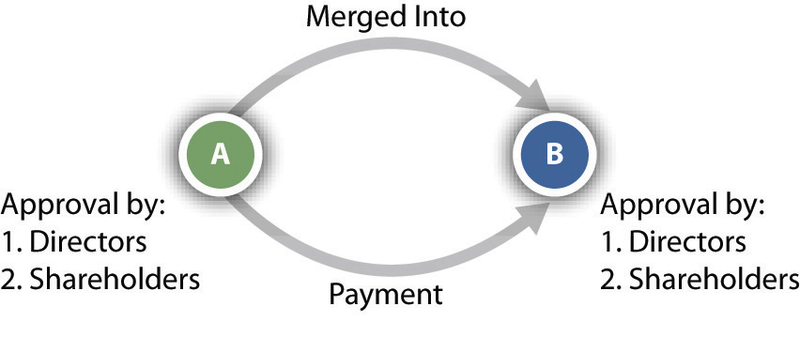

Unless the articles of incorporation state otherwise, majority approval of the merger by both boards of directors and both sets of shareholders is necessary (see Figure 29.2). The shareholder majority must be of the total shares eligible to vote, not merely of the total actually represented at the special meeting called for the purpose of determining whether to merge.

- 1954 reads