The law of secured transactions consists of five principal components: (1) the nature of property that can be the subject of a security interest; (2) the methods of creating the security interest; (3) the perfection of the security interest against claims of others; (4) priorities among secured and unsecured creditors—that is, who will be entitled to the secured property if more than one person asserts a legal right to it; and (5) the rights of creditors when the debtor defaults. After considering the source of the law and some key terminology, we examine each of these components in turn.

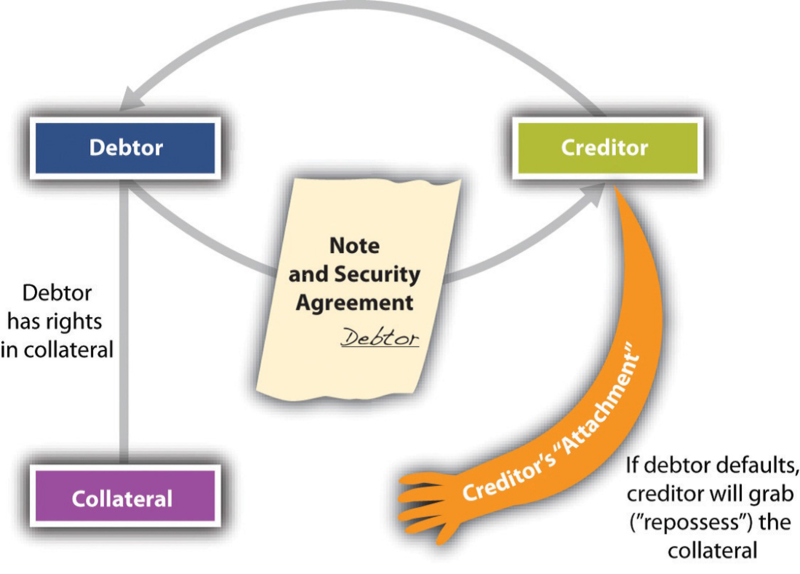

Here is the simplest (and most common) scenario: Debtor borrows money or obtains credit from Creditor, signs a note and security agreement putting up collateral, and promises to pay the debt or, upon Debtor’s default, let Creditor (secured party) take possession of (repossess) the collateral and sell it. Figure 33.1 illustrates this scenario—the grasping hand is Creditor’s reach for the collateral, but the hand will not close around the collateral and take it (repossess) unless Debtor defaults.

- 2252 reads