Until 1969, lenders were generally free to disclose the cost of money loaned or credit extended in any way they saw fit—and they did. Financing and credit terms varied widely, and it was difficult and sometimes impossible to understand what the true cost was of a particular loan, much less to comparison shop. After years of failure, consumer interests finally persuaded Congress to pass a national law requiring disclosure of credit costs in 1968. Officially called the Consumer Credit Protection Act, Title I of the law is more popularly known as the Truth in Lending Act (TILA). The act only applies to consumer credit transactions, and it only protects natural-person debtors—it does not protect business organization debtors.

The act provides what its name implies: lenders must inform borrowers about significant terms of the credit transaction. The TILA does not establish maximum interest rates; these continue to be governed by state law. The two key terms that must be disclosed are the finance charge and the annual percentage rate. To see why, consider two simple loans of $1,000, each carrying interest of 10 percent, one payable at the end of twelve months and the other in twelve equal installments. Although the actual charge in each is the same—$100—the interest rate is not. Why? Because with the first loan you will have the use of the full $1,000 for the entire year; with the second, for much less than the year because you must begin repaying part of the principal within a month. In fact, with the second loan you will have use of only about half the money for the entire year, and so the actual rate of interest is closer to 15 percent. Things become more complex when interest is compounded and stated as a monthly figure, when different rates apply to various portions of the loan, and when processing charges and other fees are stated separately. The act regulates open-end credit (revolving credit, like charge cards) and closed-end credit (like a car loan—extending for a specific period), and—as amended later—it regulates consumer leases and credit card transactions, too.

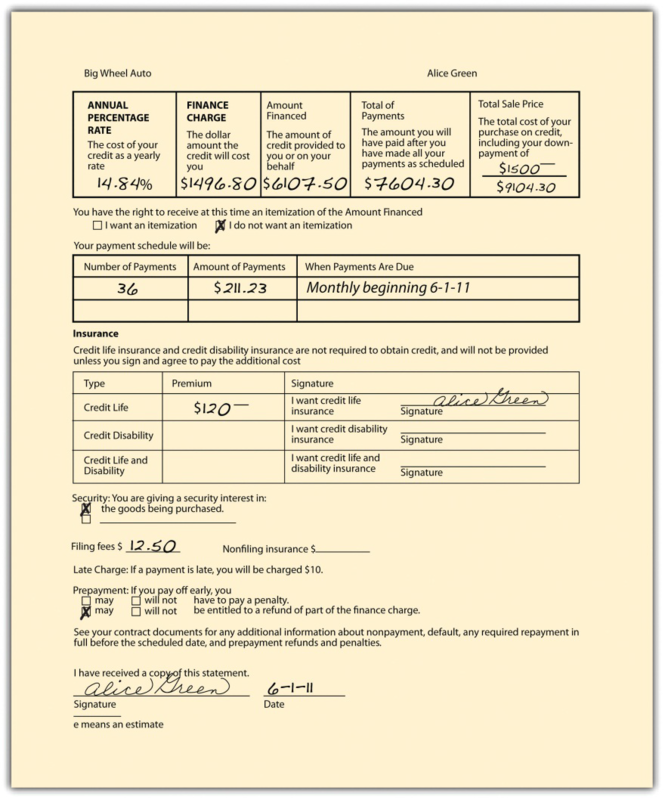

By requiring that the finance charge and the annual percentage rate be disclosed on a uniform basis, the TILA makes understanding and comparison of loans much easier. The finance charge is the total of all money paid for credit; it includes the interest paid over the life of the loan and all processing charges. The annual percentage rate is the true rate of interest for money or credit actually available to the borrower. The annual percentage rate must be calculated using the total finance charge (including all extra fees). See Figure 32.1 for an example of a disclosure form used by creditors.

- 1835 reads