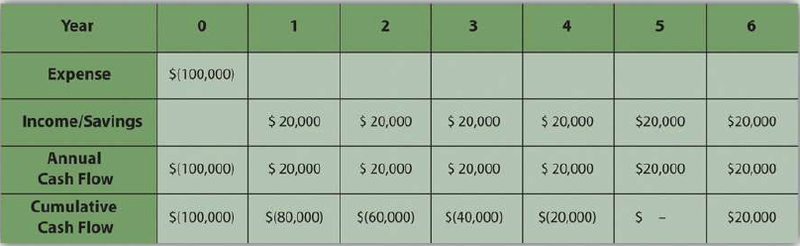

To help managers choose between projects, they can use an unsophisticated measurement called simple payback. If the purpose of the project is to improve cash flow—make it more positive or less negative—the improved positive cash flow each year is applied to the original cost (negative cash flow) of the project to determine how many years it would take to pay back the original cost. It is assumed that after that date, the improved cash flow could be used for other purposes or paid out to owners. For example, if the company borrows $100,000 to fund the project and the project increases cash flow by $20,000 a year, the simple payback would be five years, as shown in Figure 7.2.

Companies can use simple payback to establish a cutoff for project consideration. For example, management could declare that no projects will be considered that have a payback of more than three years. For projects that meet this criterion, projects with shorter simple payback periods would have an advantage in the selection process. Not-for-profit or government organizations are likely to approve projects with longer simple payback periods because they are not compared to other not-for-profit or government agencies based on their profitability.

- 1728 reads