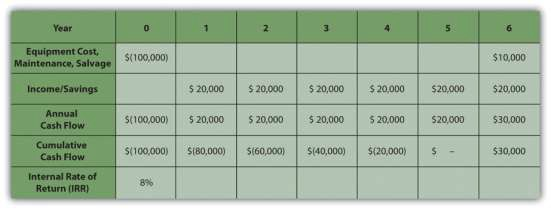

Companies whose mission is to make a profit are usually trying to make more profit than their competitors. Simply paying back the loan is not sufficient. If the project involves buying and installing equipment to make a profit, executives can use another method called internal rate of return (IRR). The IRR is like an internal interest rate that can be used to compare the profitability of competing projects. To calculate an IRR, the company considers the cash flow each year for the expected life of the product of the project. It assumes that some of the annual cash flows will be negative and that they can vary from year to year due to other factors, such as lost production during changeover, periodic maintenance, and sale of used equipment. For example, a company decides to upgrade a manufacturing line with new equipment based on new technology. They know that the initial cash flow—shown in year zero—will be negative due to the expense of the conversion. They know that the new equipment has an expected life of six years before newer technologies make it out of date, at which time they can sell it for a certain salvage value. The inputs to the IRR calculation are the net cash flow for each year where at least one of them is negative and at least one of them is positive. The result is a percentage that indicates how well this project performs as an investment. Refer to Figure 7.3.

The life of the equipment is part of the IRR calculation. If a project manager knows that senior management intends to sell the equipment in six years, team members can be made aware of that decision if it affects their choices.

- 1654 reads