In the previous section we learned that a firm’s decision to acquire and keep capital depends on the net present value of the capital in question, which in turn depends on the interest rate. The lower the interest rate, the greater the amount of capital that firms will want to acquire and hold, since lower interest rates translate into more capital with positive net present values. The desire for more capital means, in turn, a desire for more loanable funds. Similarly, at higher interest rates, less capital will be demanded, because more of the capital in question will have negative net present values. Higher interest rates therefore mean less funding demanded.

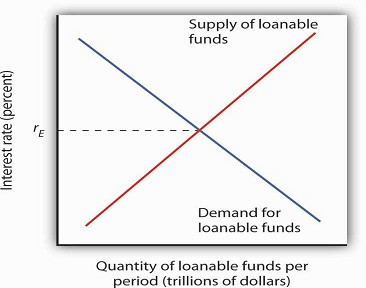

Thus the demand for loanable funds is downward-sloping, like the demand for virtually everything else, as shown in Figure 13.2. The lower the interest rate, the more capital firms will demand. The more capital that firms demand, the greater the funding that is required to finance it.

At lower interest rates, firms demand more capital and therefore more loanable funds. The demand for loanable funds is downwardsloping.the supply of loanable funds is generally upward-sloping. The equilibrium interest rate, rE, will be found where the two curves intersect.

- 2388 reads