The proposition that a private market will allocate resources efficiently if the efficiency condition is met always comes with a qualification: the allocation of resources will be efficient given the initial distribution of income. If 5% of the people receive 95% of the income, it might be efficient to allocate roughly 95% of the goods and services produced to them. But many people (at least 95% of them!) might argue that such a distribution of income is undesirable and that the allocation of resources that emerges from it is undesirable as well.

There are several reasons to believe that the distribution of income generated by a private economy might not be satisfactory. For example, the incomes people earn are in part due to luck. Much income results from inherited wealth and thus depends on the family into which one happens to have been born. Likewise, talent is distributed in unequal measure. Many people suffer handicaps that limit their earning potential. Changes in demand and supply can produce huge changes in the values—and the incomes—the market assigns to particular skills. Given all this, many people argue that incomes should not be determined solely by the marketplace.

A more fundamental reason for concern about income distribution is that people care about the welfare of others. People with higher incomes often have a desire to help people with lower incomes. This preference is demonstrated in voluntary contributions to charity and in support of government programs to redistribute income.

A public goods argument can be made for government programs that redistribute income. Suppose that people of all income levels feel better off knowing that financial assistance is being provided to the poor and that they experience this sense of well-being whether or not they are the ones who provide the assistance. In this case, helping the poor is a public good. When the poor are better off, other people feel better off; this benefit is nonexclusive. One could thus argue that leaving private charity to the marketplace is inefficient and that the government should participate in income redistribution. Whatever the underlying basis for redistribution, it certainly occurs. The governments of every country in the world make some effort to redistribute income.

Programs to redistribute income can be divided into two categories. One transfers income to poor people; the other transfers income based on some other criterion. A means-tested transfer payment is one for which the recipient qualifies on the basis of income; means-tested programs transfer income from people who have more to people who have less. The largest means-tested program in the United States is Medicaid, which provides health care to the poor. Other means-tested programs include Temporary Assistance to Needy Families (TANF) and food stamps. A non-means-tested transfer payment is one for which income is not a qualifying factor. Social Security, a program that taxes workers and their employers and transfers this money to retired workers, is the largest non-meanstested transfer program. Indeed, it is the largest transfer program in the United States. It transfers income from working families to retired families. Given that retired families are, on average, wealthier than working families, Social Security is a somewhat regressive program. Other non-means tested transfer programs include Medicare, unemployment compensation, and programs that aid farmers.

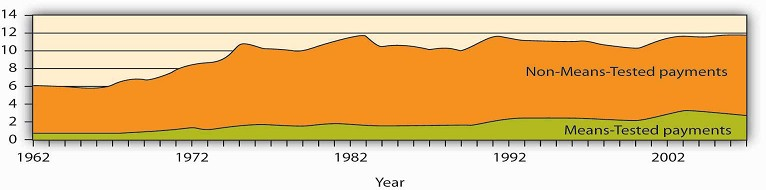

Figure 15.4 shows federal spending on means-tested and non-means-tested programs as a percentage of GDP, the total value of output, since 1962. As the chart suggests, the bulk of income redistribution efforts in the United States are non-means-tested programs.

The chart shows federal means-tested and non-means-tested transfer payment spending as a percentage of GDP from 1962–2007.

Source: Congressional Budget Office, The Budget and Economic Outlook: Fiscal Years 2004–2013 (Jan., 2003), Table F-10p. 157; thereafter January,2008, Table F-10 with means-tested as medicaid plus income security and non-means tested everything else.

The fact that most transfer payments in the United States are not means-tested leads to something of a paradox: some transfer payments involve taxing people whose incomes are relatively low to give to people whose incomes are relatively high. Social Security, for example, transfers income from people who are working to people who have retired. But many retired people enjoy higher incomes than working people in the United States. Aid to farmers, another form of non-means-tested payments, transfers income to farmers, who on average are wealthier than the rest of the population. These situations have come about because of policy decisions, which we discuss later in the chapter.

KEY TAKEAWAYS

- One role of government is to correct problems of market failure associated with public goods, external costs and benefits, and imperfect competition.

- Government intervention to correct market failure always has the potential to move markets closer to efficient solutions, and thus reduce deadweight losses.There is however,no guarantee that these gains will be achieved.

- Governments may seek to alter the provision of certain goods and services based on a normative judgment that consumers will consume too much or too little of the goods. Goods for which such judgments are made are called merit or demerit goods.

- Governments redistribute income through transfer payments. Such redistribution often goes from people with higher incomes to people with lower incomes, but other transfer payments go to people who are relatively better off.

TRY IT!

Here is a list of actual and proposed government programs. Each is a response to one of the justifications for government activity described in the text: correction of market failure (due to

public goods, external costs, external benefits, or imperfect competition), encouragement or discouragement of the consumption of merit or demerit goods, and redistribution of income.

In each case, identify the source of demand for the activity described.

- The Justice Department sought to prevent Microsoft Corporation from releasing Windows ’98, arguing that the system’s built-in internet browser represented an attempt by Microsoft to monopolize the market for browsers.

- In 2004, Congress considered a measure that would extend taxation of cigarettes to vendors that sell cigarettes over the Internet.

- The federal government engages in research to locate asteroids that might hit the earth, and studies how impacts from asteroids could be prevented.

- The federal government increases spending for food stamps for people whose incomes fall below a certain level.

- The federal government increases benefits for recipients of Social Security.

- The Environmental Protection Agency sets new standards for limiting the emission of pollutants into the air.

- A state utilities commission regulates the prices charged by utilities that provide natural gas to homes and businesses.

Moderating the price of gasoline is not an obvious mission for the government in a market economy. But, in an economy in which angry voters wield considerable influence, trying to fix rising

gasoline prices can turn into a task from which a wise politician does not shrink.

By the summer of 2008, crude oil was selling for more than $140 per barrel. Gasoline prices in the United States were flirting with the $4 mark. There were perfectly good market reasons for

the run-up in prices. World oil demand has been rising each year, with China and India two of the primary sources of increased demand. The world’s ability to produce oil is limited and

tensions in the Middle East were also adding doubts about getting those supplies to market. Ability to produce gasoline is limited as well. The United States has not built a new oil refinery

in more than 30 years.

But, when oil prices rise, economic explanations seldom carry much political clout. Predictably, the public demands a response from its political leaders—and gets it.

Largely Democratic Congressional proposals in 2008 included such ideas as: a bill to classify the Organization of Petroleum Exporting Countries (OPEC) as an illegal monopoly in violation of

U.S. antitrust laws, taxing “excessive” profits of oil companies, investigating possible price gouging, and banning speculative trading in oil futures. With an overwhelming majority on both

sides of the aisle, Congress passed a bill to suspend adding oil to the Strategic Petroleum Reserve—a 727 million gallon underground reserve designed for use in national emergencies.

President Bush in 2008 was against this move, though in 2006, when gas prices were approaching $3 a gallon, he supported a similar move. Whether or not to offer a “tax holiday” on the 18.4

cents per gallon federal gas tax stymied some politicians during the 2008 presidential campaign because Hillary Clinton, a Democrat, and John McCain, a Republican, supported it, while Barack

Obama, a Democrat, was against it. Mostly Republican proposals to allow offshore drilling and exploration in the Arctic National Wildlife Refuge also received attention.

These measures were unlikely to have much affect on gas prices, especially in the short-term. For example, the federal government would normally in a two-month period deposit 10 million

gallons of gasoline in the strategic reserve; consumption in the United States is about 20 million gallons of gasoline per day. World gasoline consumption is about 87 million gallons per day.

Putting an additional 10 million gallons into a global market which will consume about 5 billion gallons in a 60day period is not likely to have any measurable impact.

The higher oil prices were very good for oil companies. Exxon Mobil, the largest publicly traded oil company in the United States, reported profits of nearly $11 billion for the first quarter

of 2008. Whenever oil prices rise sharply, there are always cries of “price gouging.” But, repeated federal investigations of the industry have failed to produce any evidence that such

gouging has occurred.

Meanwhile, market forces responding to the higher gasoline prices are already at work. Gasoline producers are looking at cellulosic ethanol, which can be produced from materials such as wood

chips, corn stalks, and rice straw. Automobile producers are examining “plug-in” hybrids—cars whose batteries could be charged not just by driving but by plugging the car in a garage. The

goal is to have a car that could go some distance on its battery before starting to use any gasoline. Consumers are doing their part. Gasoline consumption in the United States fell more than

4% by the summer of 2008 from its level one year earlier.

These potential market responses are the sort of thing one would expect from rising fuel prices. Ultimately, it is difficult to see why gasoline prices should be a matter for public sector

intervention. But, the public sector consists of people, and when those people become angry, the urge for intervention can become unstoppable.

Sources: Paul Davidson and Chris Woodyard, “Proposals To Cut Gas Prices Scrutinized,” USA Today, May 11, 2006, p. 5B; Joseph Curl, “Bush Orders Suspension Of Gas Rules; Federal Probe To Look

At Price-Gouging Charges,” The Washington Times, April 26, 2007, p. A1; David M. Herszenhorn, “As Gasoline Prices Soar, Politicians Fall Back on Familiar Solutions,” The New York Times, May

3, 2008, p. A16; Richard Simon, “The Nation; Mixing Oil and Politics; Congress Votes To Stop Shipments to the Nation’s Reserve. The Move Could Save Motorists Some Money,” Los Angeles Times,

May 14, 2008, p. A18.

ANSWERS TO TRY IT! PROBLEMS

- This is an attempt to deal with monopoly, so it is a response to imperfect competition.

- Cigarettes are treated as a demerit good.

- Protecting the earth from such a calamity is an example of a public good.4

- Food Stamps are a means-tested program to redistribute income.

- Social Security is an example of a non-means-tested income redistribution program.

- This is a response to external costs.

- This is a response to monopoly, so it falls under the imperfect competition heading.

- 3709 reads