Gross private domestic investment is the value of all goods produced during a period for use in the production of other goods and services. Like personal consumption, gross private domestic investment is a flow variable. It is often simply referred to as “private investment.” A hammer produced for a carpenter is private investment. A printing press produced for a magazine publisher is private investment, as is a conveyor-belt system produced for a manufacturing firm. Capital includes all the goods that have been produced for use in producing other goods; it is a stock variable. Private investment is a flow variable that adds to the stock of capital during a period.

Heads Up!

The term “investment” can generate confusion. In everyday conversation, we use the term “investment” to refer to uses of money to earn income. We say we have invested in a stock or invested in a bond. Economists, however, restrict “investment” to activities that increase the economy’s stock of capital. The purchase of a share of stock does not add to the capital stock; it is not investment in the economic meaning of the word.We refer to the exchange of financial assets, such as stocks or bonds, as financial investment to distinguish it from the creation of capital that occurs as the result of investment. Only when new capital is produced does investment occur. Confusing the economic concept of private investment with the concept of financial investment can cause misunderstanding of the way in which key components of the economy relate to one another. Gross private domestic investment includes three flows that add to or maintain the nation’s capital stock: expenditures by business firms on new buildings, plants, tools, equipment, and software that will be used in the production of goods and services; expenditures on new residential housing; and changes in business inventories. Any addition to a firm’s inventories represents an addition to investment; a reduction subtracts from investment. For example, if a clothing store stocks 1,000 pairs of jeans, the jeans represent an addition to inventory and are part of gross private domestic investment. As the jeans are sold, they are subtracted from inventory and thus subtracted from investment.

By recording additions to inventories as investment and reductions from inventories as subtractions from investment, the accounting for GDP records production in the period in which it occurs. Suppose, for example, that Levi Strauss manufactures 1 million pairs of jeans late in 2007 and distributes them to stores at the end of December. The jeans will be added to inventory; they thus count as investment in 2007 and enter GDP for that year. Suppose they are sold in January 2008. They will be counted as consumption in GDP for 2008 but subtracted from inventory, and from investment. Thus, the production of the jeans will add to GDP in 2007, when they were produced. They will not count in 2008, save for any increase in the value of the jeans resulting from the services provided by the retail stores that sold them.

Private investment accounts for about 16% of GDP. Despite its relatively small share of total economic activity, private investment plays a crucial role in the macroeconomy for two reasons: Private investment represents a choice to forgo current consumption in order to add to the capital stock of the economy. Private investment therefore adds to the economy’s capacity to produce and shifts its production possibilities curve outward. Investment is thus one determinant of economic growth, which is explored in another chapter. Private investment is a relatively volatile component of GDP; it can change dramatically from one year to the next. Fluctuations in GDP are often driven by fluctuations in private investment. We will examine the determinants of private investment in a chapter devoted to the study of investment.

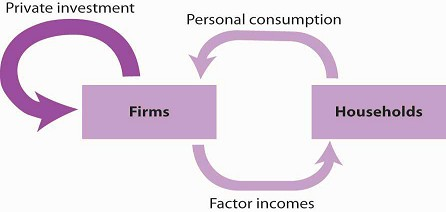

Private investment represents a demand placed on firms for the production of capital goods. While it is a demand placed on firms, it flows from firms. In the circular flow model in Figure Figure 21.2, we see a flow of investment going from firms to firms. The production of goods and services for consumption generates factor incomes to households; the production of capital goods for investment generates income to households as well.

Figure Figure 21.2 shows only spending flows and omits the physical flows represented by the arrows in Figure Figure 21.1. This simplification will make our analysis of the circular flow model easier. It will also focus our attention on spending flows, which are the flows we will be studying.

Private investment constitutes a demand placed on firms by other firms. It also generates factor incomes for households. To simplify the diagram, only the spending flows are shown—the corresponding flows of goods and services have been omitted.

- 1396 reads