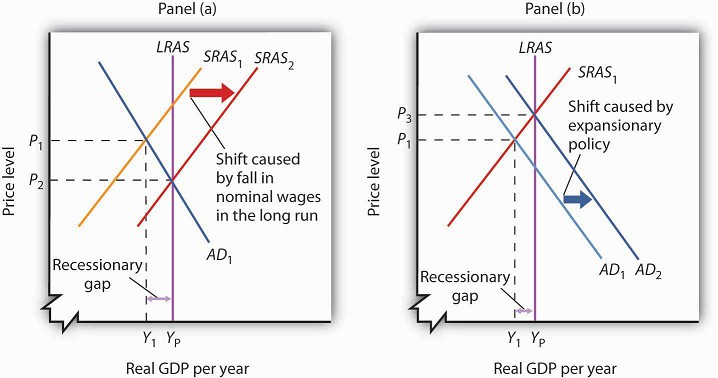

Figure 22.13 illustrates the alternatives for closing a recessionary gap. In both panels, the economy starts with a real GDP of Y1 and a price level of P1. There is a recessionary gap equal to YP − Y1. In Panel (a), the economy closes the gap through a process of self-correction. Real and nominal wages will fall as long as employment remains below the natural level. Lower nominal wages shift the short-run aggregate supply curve. The process is a gradual one, however, given the stickiness of nominal wages, but after a series of shifts in the short-run aggregate supply curve, the economy moves toward equilibrium at a price level of P2 and its potential output of YP.

Panel (a) illustrates a gradual closing of a recessionary gap. Under a nonintervention policy, short-run aggregate supply shifts from SRAS1 to SRAS2. Panel (b) shows the effects of expansionary policy acting on aggregate demand to close the gap.

Panel (b) illustrates the stabilization alternative. Faced with an economy operating below its potential, public officials act to stimulate aggregate demand. For example, the government can increase government purchases of goods and services or cut taxes. Tax cuts leave people with more after-tax income to spend, boost their consumption, and increase aggregate demand. As AD1 shifts to AD2 in Panel (b) of Figure 22.13, the economy achieves output of YP, but at a higher price level, P3. A stabilization policy designed to increase real GDP is known as an expansionary policy.

- 3145 reads