People purchase a country’s currency for two quite different reasons: to purchase goods or services in that country, or to purchase the assets of that country—its money, its capital,

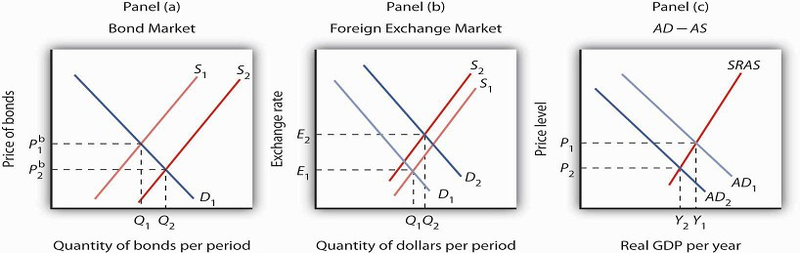

its stocks, its bonds, or its real estate. Both of these motives must be considered to understand why demand and supply in the foreign exchange market may change. One thing that can cause the price of the dollar to rise, for example, is a reduction in bond prices in American markets. Figure 25.4 illustrates the effect of this change. Suppose the supply of bonds in the U.S. bond market increases from S1 to S2 in Panel (a). Bond prices will drop. Lower bond prices mean higher interest rates. Foreign financial investors, attracted by the opportunity to earn higher returns in the United States, will increase their demand for dollars on the foreign exchange market in order to purchase U.S. bonds. Panel (b) shows that the demand curve for dollars shifts from D1 to D2. Simultaneously, U.S. financial investors, attracted by the higher interest rates at home, become less likely to make financial investments abroad and thus supply fewer dollars to exchange markets. The fall in the price of U.S. bonds shifts the supply curve for dollars on the foreign exchange market from S1 to S2, and the exchange rate rises from E1 to E2.

In Panel (a), an increase in the supply of bonds lowers bond prices to Pb 2 (and thus raises interest rates). Higher interest rates boost the demand and reduce the supply for dollars, increasing the exchange rate in Panel (b) to E2. These developments in the bond and foreign exchange markets are likely to lead to a reduction in net exports and in investment, reducing aggregate demand from AD1 to AD2 in Panel (c). The price level in the economy falls to P2, and real GDP falls from Y1 to Y2.

The higher exchange rate makes U.S. goods and services more expensive to foreigners, so it reduces exports. It makes foreign goods cheaper for U.S. buyers, so it increases imports. Net exports thus fall, reducing aggregate demand. Panel (c) shows that output falls from Y1 to Y2; the price level falls from P1 to P2. This development in the foreign exchange market reinforces the impact of higher interest rates we observed in Figure 25.2, Panels (c) and (d). They not only reduce investment—they reduce net exports as well.

KEY TAKEAWAYS

- A bond represents a borrower’s debt; bond prices are determined by demand and supply.

- The interest rate on a bond is negatively related to the price of the bond. As the price of a bond increases, the interest rate falls.

- An increase in the interest rate tends to decrease the quantity of investment demanded and, hence, to decrease aggregate demand. A decrease in the interest rate increases the quantity of investment demanded and aggregate demand.

- The demand for dollars on foreign exchange markets represents foreign demand for U.S. goods, services, and assets. The supply of dollars on foreign exchange markets represents U.S. demand for foreign goods, services, and assets. The demand for and the supply of dollars determine the exchange rate.

- A rise in U.S. interest rates will increase the demand for dollars and decrease the supply of dollars on foreign exchange markets. As a result, the exchange rate will increase and aggregate demand will decrease. A fall in U.S. interest rates will have the opposite effect.

TRY IT!

Suppose the supply of bonds in the U.S. market decreases. Show and explain the effects on the bond and foreign exchange markets. Use the aggregate demand/aggregate supply framework to show and explain the effects on investment, net exports, real GDP, and the price level.

Case in Point: Betting on a Plunge

In 2004, a certain Thomas J. from Florida had a plan. He understood clearly the inverse relationship between bond prices and interest rates. What he did not understand was how expensive

guessing incorrectly the direction of interest rates would be when he decided to buy into an “inverse bond” fund.

An “inverse bond” fund is one that performs well when bond prices fall. The fund Thomas bought into happened to trade in 30-year U.S. Treasury bonds, and Thomas guessed that interest rates on

them would rise.

The only problem with the plan was that the interest rate on 30-year bonds actually fell over the next year. So, the fund Thomas bought into lost value when the prices of these bonds rose.

Expenses associated with this type of fund exacerbated Thomas’s loss. If only Thomas had known both the relationship between bond prices and interest rates and the direction of interest

rates!

Perhaps another thing he did not understand was that when he heard that the Federal Reserve was raising rates in 2004 that this referred to the federal funds rates, a very short-term interest

rate. While other short-term interest rates moved with the federal funds rate in 2004, long-term rates did not even blink.

Source: Chuck Jaffee, “Don’t Be Stupid: He Had Little Fun with ‘Inverse Bond Funds,’” Boston Herald, June 14, 2005, p. 34.

ANSWER TO TRY IT! PROBLEM

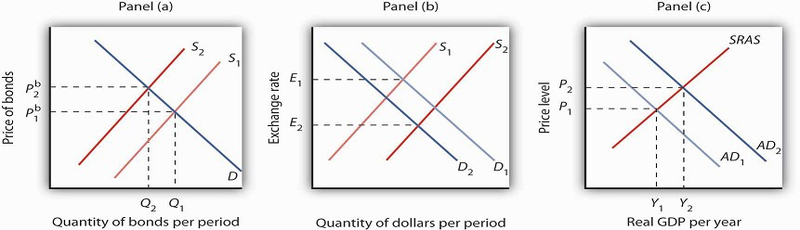

If the supply of bonds decreases from S1 to S2, bond prices will rise from Pb 1 to Pb 2, as shown in Panel (a). Higher bond prices mean lower interest rates. Lower interest rates in the

United States will make financial investments in the United States less attractive to foreigners. As a result, their demand for dollars will decrease from D1 to D2, as shown in Panel (b).

Similarly, U.S. financial investors will look abroad for higher returns and thus supply more dollars to foreign exchange markets, shifting the supply curve from S1 to S2. Thus, the exchange

rate will decrease. The quantity of investment rises due to the lower interest rates. Net exports rise because the lower exchange rate makes U.S. goods and services more attractive to

foreigners, thus increasing exports, and makes foreign goods less attractive to U.S. buyers, thus reducing imports. Increases in investment and net exports imply a rightward shift in the

aggregate demand curve from AD1 to AD2. Real GDP and the price level increase.

- 2474 reads