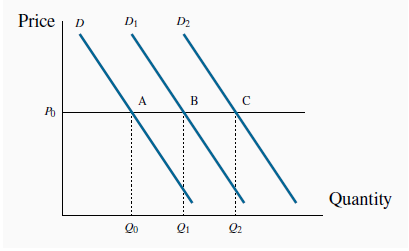

The income elasticity of demand, in diagrammatic terms, is a percentage measure of how far the demand curve shifts in response to a change in income. Figure 4.7 shows two possible shifts. Suppose the demand curve

is initially the one defined by D, and then income increases. If the demand curve shifts to  as a result, the change in quantity demanded at the existing price is (

as a result, the change in quantity demanded at the existing price is ( -

-  ). However, if instead the demand curve shifts to

). However, if instead the demand curve shifts to  , that shift denotes a larger change in quantity (

, that shift denotes a larger change in quantity ( -

-  ).

Since the shift in demand denoted by

).

Since the shift in demand denoted by  exceeds the shift to

exceeds the shift to

, the

, the  shift is more responsive to income, and therefore implies a higher income elasticity.

shift is more responsive to income, and therefore implies a higher income elasticity.

At the price  , the income elasticity measures the percentage

horizontal shift in demand caused by some percentage income increase. A shift in B reflects a lower income elasticity than a shift to C. A leftward shift in the demand curve in response to an

income increase would denote a negative income elasticity – an inferior good.

, the income elasticity measures the percentage

horizontal shift in demand caused by some percentage income increase. A shift in B reflects a lower income elasticity than a shift to C. A leftward shift in the demand curve in response to an

income increase would denote a negative income elasticity – an inferior good.

In this example, the good is a normal good, as defined in The classical marketplace – demand and supply, because the demand for it increases in response to income increases. If the demand curve were to shift back to the left in response to an increase in income, then the income elasticity would be negative. In such cases the goods or services are inferior, as defined in The classical marketplace – demand and supply.

Finally, we need to distinguish between luxuries, necessities, and inferior goods. A luxury good or service is one whose income elasticity exceeds unity. A necessity is one whose income elasticity is less than unity. These elasticities can be understood with the help of Equation 4.1 part (a). If quantity demanded is so responsive to an income increase that the percentage increase in quantity demanded exceeds the percentage increase in income, then the value is in excess of 1, and the good or service is called a luxury. In contrast, if the percentage change in quantity demanded is less than the percentage increase in income, the value is less than unity, and we call the good or service a necessity.

A luxury good or service is one whose income

elasticity exceeds unity.

A luxury good or service is one whose income

elasticity exceeds unity.

A necessity is one whose income elasticity is

less than unity.

A necessity is one whose income elasticity is

less than unity.

Luxuries and necessities can also be defined in terms of their share of a typical budget. An income elasticity greater than unity means that the share of an individual’s budget being allocated to the product is increasing. In contrast, if the elasticity is less than unity, the budget share is falling. This makes intuitive sense—luxury cars are luxury goods by this definition because they take up a larger share of the incomes of the rich than of the poor.

Inferior goods are those for which there exist higher-quality, more expensive, substitutes. For example, lower-income households tend to satisfy their travel needs by using public transit. As income rises, households normally reduce their reliance on public transit in favour of automobile use. Inferior goods, therefore, have a negative income elasticity: in the income elasticity equation definition, the numerator has a sign opposite to that of the denominator. As an example: in the recession of 2008/09 McDonalds continued to remain profitable and increased its customer base – in contrast to the more up-market Starbucks. This is a case where expenditure increased following a decline in income, yielding a negative income elasticity of demand.

Inferior goods have negative income elasticity.

Inferior goods have negative income elasticity.

Lastly, note that all inferior products are clearly necessities, but necessities include normal products with elasticities between zero and one.

Empirical research indicates that goods like food and fuel have income elasticities less than 1; durable goods and services have elasticities slightly greater than 1; leisure goods and foreign

holidays have elasticities very much greater than 1.

Income elasticities are useful in forecasting the demand for particular services and goods in a growing economy. Suppose real income is forecast to grow by 15 percent over the next five years.

If we know that the income elasticity of demand for iPhones is 2.0, we could estimate the anticipated growth in demand by using the income elasticity formula: since in this case  = 2.0 and %

= 2.0 and % I = 15 it follows that 2.0 = %

I = 15 it follows that 2.0 = % Q/15%. Therefore the predicted demand change must be 30%.

Q/15%. Therefore the predicted demand change must be 30%.

- 81243 reads