The key attributes of a perfectly competitive market are the following:

- There must be many firms, each one small and powerless relative to the entire industry.

- The product must be standardized. Barber shops offer a standard product, but a Lexus differs from a Ford. Barbers tend to be price takers, but Lexus does not charge the same price as Ford, and is a price setter.

- Buyers are assumed to have full information about the product and its pricing. For example, buyers know that the products of different suppliers really are the same in quality.

- There are many buyers.

- There is free entry and exit of firms.

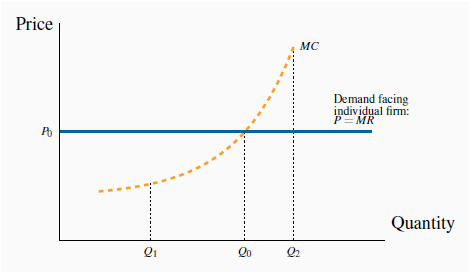

In terms of the demand curve that suppliers face, the foregoing characteristics imply that the demand curve facing the firm is horizontal, or infinitely elastic, as we defined in Measures of response: elasticities. In contrast, the demand curve facing the whole industry is downward sloping.

In terms of Figure 9.1, the individual firm can sell any amount at the price P0. If it tries to charge a price above this, its output will not be purchased.

Here, Qo represents the optimal supply decision when the price is Po. At output  the cost of additional units is less than the revenue from such units and therefore it is profitable to increase output beyond

the cost of additional units is less than the revenue from such units and therefore it is profitable to increase output beyond

. Conversely, at

. Conversely, at  the MC of production exceeds the revenue obtained, and so output should be reduced.

the MC of production exceeds the revenue obtained, and so output should be reduced.

This last assumption is vital, because it prevents a competitive market from becoming non-competitive. For example, OPEC can restrict the world oil supply by getting its members to sell less than they would if acting independently. That market is therefore not perfectly competitive; furthermore, even though it has many suppliers, entry is not free because not all economies possess oil wells. Free entry enables new firms to enter profitable industries. The potential for profit thus induces greater supply.

By the same reasoning, when firms are losing money, they may exit and reduce the total supply. This reduction may be sufficient to drive the price back up to a level where firms can again make a profit that is sufficient to induce them to continue producing. Entry and exit are thus essential parts of the dynamic in perfect competition.

- 2797 reads