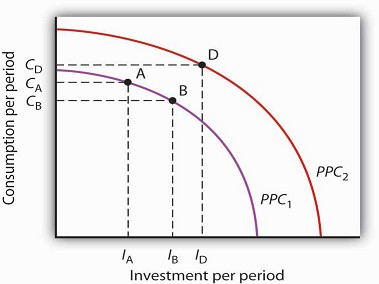

Earlier we used the production possibilities curve to illustrate how choices are made about investment, consumption, and saving. Because such choices are crucial to understanding how investment affects living standards, it will be useful to reexamine them here.

Figure 29.4 shows a production possibilities curve for an economy that can produce two kinds of goods: consumption goods and investment goods. An economy operating at point A on PPC1 is using its factors of production fully and efficiently. It is producing CA units of consumption goods and IA units of investment each period. Suppose that depreciation equals IA, so that the quantity of investment each period is just sufficient to replace depreciated capital; net investment equals zero. If there is no change in the labor force, in natural resources, or in technology, the production possibilities curve will remain fixed at PPC1.

Now suppose decision makers in this economy decide to sacrifice the production of some consumption goods in favor of greater investment. The economy moves to point B on PPC1. Production of consumption goods falls to CB, and investment rises to IB. Assuming depreciation remains IA, net investment is now positive. As the nation’s capital stock increases, the production possibilities curve shifts outward to PPC2. Once that shift occurs, it will be possible to select a point such as D on the new production possibilities curve. At this point, consumption equals CD, and investment equals ID. By sacrificing consumption early on, the society is able to increase both its consumption and investment in the future. That early reduction in consumption requires an increase in saving.

We see that a movement along the production possibilities curve in the direction of the production of more investment goods and fewer consumption goods allows the production of more of both types of goods in the future.

A society with production possibilities curve PPC1 could choose to produce at point A, producing CA consumption goods and investment of IA. If depreciation equals IA, then net investment is zero, and the production possibilities curve will not shift, assuming no other determinants of the curve change. By cutting its production of consumption goods and increasing investment to IB, however, the society can, over time, shift its production possibilities curve out to PPC2, making it possible to enjoy greater production of consumption goods in the future.

KEY TAKEAWAYS

- Investment adds to the nation’s capital stock. 948

- Gross private domestic investment includes the construction of nonresidential structures, the production of equipment and software, private residential construction, and changes in inventories.

- The bulk of gross private domestic investment goes to the replacement of depreciated capital.

- Investment is the most volatile component of GDP. 54.Investment represents a choice to postpone consumption—it requires saving.

TRY IT!

Which of the following would be counted as gross private domestic investment?

- Millie hires a contractor to build a new garage for her home.

- Millie buys a new car for her teenage son.

- Grandpa buys Tommy a savings bond.

- General Motors builds a new automobile assembly plant.

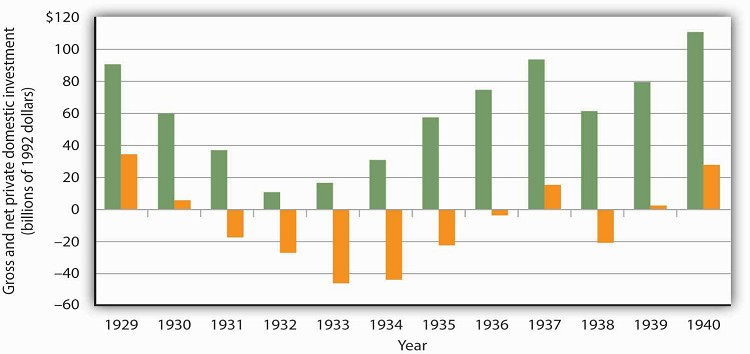

Case in Point: The Reduction of Private Capital in the Depression

Net private domestic investment (NPDI) has been negative during only two periods in the last 70 years. During one period, World War II, massive defense spending forced cutbacks in private

sector spending. (Recall that government investment is not counted as part of net private domestic investment in the official accounts; production of defense capital thus is not reflected in

these figures.) The other period in which NPDI was negative was the Great Depression.

Aggregate demand plunged during the first four years of the Depression. As firms cut their output in response to reductions in demand, their need for capital fell as well. They reduced their

capital by holding gross private domestic investment below depreciation beginning in 1931. That produced negative net private domestic investment; it remained negative until 1936 and became

negative again in 1938. In all, firms reduced the private capital stock by more than $529.5 billion (in 2007 dollars) during the period.

ANSWERS TO TRY IT! PROBLEMS

- A new garage would be part of residential construction and thus part of GPDI.

- Consumer purchases of cars are part of the consumption component of the GDP accounts and thus not part of GPDI.

- The purchase of a savings bond is an example of a financial investment. Since it is not an addition to the nation’s capital stock, it is not part of GPDI.

- The construction of a new factory is counted in the nonresidential structures component of GPDI.

- 3100 reads