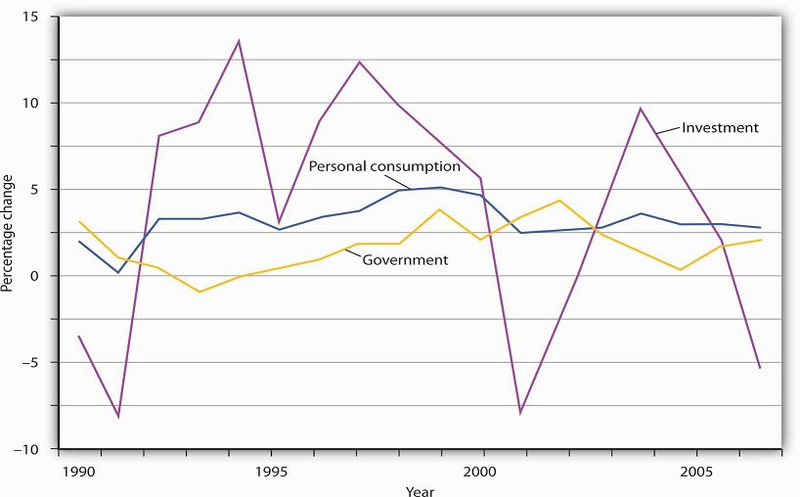

Investment, measured as GPDI, is among the most volatile components of GDP. In percentage terms, year-to-year changes in GPDI are far greater than the year-to-year changes in consumption or government purchases. Net exports are also quite volatile, but they represent a much smaller share of GDP. Figure 29.3 compares annual percentage changes in GPDI, personal consumption, and government purchases. Of course, a dollar change in investment will be a much larger change in percentage terms than a dollar change in consumption, which is the largest component of GDP. But compare investment and government purchases: their shares in GDP are comparable, but investment is clearly more volatile.

Annual percentage changes in real GPDI have been much greater than annual percentage changes in the real values of personal consumption or government purchases.

Source: Bureau of Economic Analysis, NIPA Table 1.1.1 (revised December 23, 2008).

Given that the aggregate demand curve shifts by an amount equal to the multiplier times an initial change in investment, the volatility of investment can cause real GDP to fluctuate in the short run. Downturns in investment may trigger recessions.

- 2429 reads