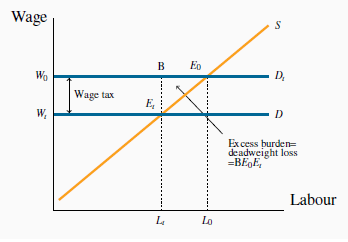

A final example will illustrate how the concerns of economists over the magnitude of the DWL are distinct from the concerns expressed in much of the public debate over taxes. Figure 5.4 illustrates the demand and supply for a

certain type of labour. On the demand side, the analysis is simplified by assuming that the demand for labour is horizontal, indicating that the gross wage rate is fixed, regardless of the

employment level. On the supply side, the upward slope indicates that individuals supply more labour if the wage is higher. The equilibrium  reflects that

reflects that  units of labour are supplied at the gross, that is, pre-tax wage

units of labour are supplied at the gross, that is, pre-tax wage  .

.

The demand for labour is horizontal at  . A tax on labour reduces

the wage paid to

. A tax on labour reduces

the wage paid to  . The loss in supplier surplus is the

area

. The loss in supplier surplus is the

area . The government takes

. The government takes in tax revenue, leaving

in tax revenue, leaving  as the DWL of the wage tax.

as the DWL of the wage tax.

An income tax is now imposed. If this is, say, 20 percent, then the net wage falls to 80 percent of the gross wage in this example, given the horizontal demand curve. The new

equilibrium  is defined by the combination (

is defined by the combination ( ,

,  ). Less labour is supplied because the net wage is lower. The government generates tax revenue of (

). Less labour is supplied because the net wage is lower. The government generates tax revenue of ( -

-  ) on each of the Lt units of labour now supplied, and this is the area

) on each of the Lt units of labour now supplied, and this is the area  . The loss in surplus to the suppliers is

. The loss in surplus to the suppliers is  , and therefore the DWL is the triangle

, and therefore the DWL is the triangle  . Clearly the magnitude of the DWL depends upon the supply elasticity.

. Clearly the magnitude of the DWL depends upon the supply elasticity.

Whereas the DWL consequence of the wage tax is important for economists, public debate is moreoften focused on the reduction in labour supply and production. Of course, these two issues arenot independent. A larger reduction in labour supply is generally accompanied by a bigger excess burden.

- 1874 reads