A cartel is a group of suppliers that colludes to operate like a monopolist. The most famous cartel in modern times is certainly the oil cartel formed by the members of the Organization of Oil Exporting Countries (OPEC). This cartel first flexed its muscles seriously in 1973, by increasing the world price of oil from $3 per barrel to $10 per barrel. The result was to transfer billions of dollars from the energy-importing nations in Europe and the US (and partly North America) to OPEC members – the demand for oil is relatively inelastic, hence an increase in price increases total expenditures.

A cartel is a group of suppliers that colludes to

operate like a monopolist.

A cartel is a group of suppliers that colludes to

operate like a monopolist.

A second renowned cartel is managed by De Beers, which controls a large part of the world’s diamond supply. A third is Major League Baseball in the US, which is excluded from competition law. Lesser-known cartels, but in some cases very effective, are those formed by the holders of taxi licenses in many cities throughout the world: entry is extremely costly. By limiting the right to enter the taxi industry, the incumbents can charge a higher price than if entry to the industry were free.

Some cartels are sustained through violence, and frequently wars break out between competing cartels or groups who want to sustain their market power. Drug gangs in large urban areas frequently fight for hegemony over distribution. And the recent drug wars in Mexico between rival cartels had seen tens of thousands on individuals killed as of 2012.

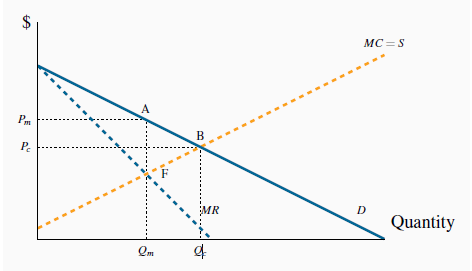

Some cartels are successful and stable, others not so, in the sense that individual members of the cartel may decide to ‘cheat’ – by undercutting the agreed price. To understand the dynamics of cartels consider Figure 10.13. Several producers, with given production capacities, come together and agree to restrict output with a view to increasing price and therefore profit. Each firm has a MC curve, and the industry supply is defined as the sum of these marginal cost curves, as illustrated in Figure 9.3. We could think of the resulting cartel as one in which there is a single supplier with many different plants – a multi-plant monopolist. To maximize profits this organization will choose an output level Qm where theMR equals theMC. In contrast, if these firms act competitively the output chosen will be Qc. The competitive output yields no supernormal profit, whereas the monopoly/cartel output does.

A cartel is formed when individual suppliers come together and act like a monopolist in order to increase profit. If MC is the joint supply curve of the cartel, profits are maximized at the output Qm, where MC =MR. In contrast, if these firms operate competitively output increases to Qc.

The cartel results in a deadweight loss equal to the area ABF, just as in the standard monopoly model.

- 4812 reads