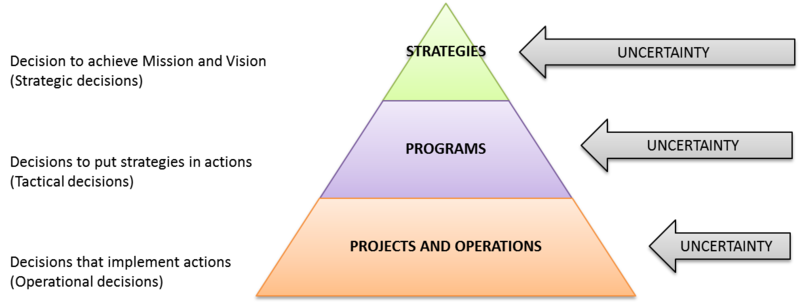

Global competition characterizes the market of the new millennium where uncertainty and volatility are the main elements affecting the decision making process of managers that need to determine scenarios, define strategies, plan interventions and investments, develop projects and execute operations (Figure 7.1).

Risks have been always part of entrepreneurships but a growing attention to the issues related to Risk Management is nowadays spreading. Along with the financial scandals in the affairs of some major corporations, the high degree of dynamism and the evolutions of markets need organizations to rapidly adapt their business models to changes, whether economic, political, regulatory, technological or social1.

In particular, managerial trends of business disintegration, decentralization and outsourcing, pushed organizations towards practices of information sharing, coordination and partnership. The difficulties that generally arise during the implementation of these practices underline the impact that critical risk factors can have on corporate governance. Operations, at any level, are highly affected in their performance by uncertainty, reducing their efficiency and effectiveness while losing control on the evolution of the value chain.

Studies on risk management have to be extended, involving not only internal processes of companies but considering also the relationship and the level of integration of supply chain partners. This can be viewed as a strategic issue of operations management to enable interventions of research, development and innovation.

In a vulnerable economy, where the attention to quality and efficiency through cost reduction is a source of frequent perturbations, an eventual error in understanding the sensibility of the operations to continuous changes can seriously and irreparably compromise the capability of fitting customers’ requirements.

Managers need to have personal skills and operational tools to ensure that risk management strategies can be suitably implemented and integrated in the production and logistics business environment. In order to face internal and external uncertainty, take advantage of it and exploit opportunities, it is necessary to identify, analyze and evaluate operational risks through standard methodologies that help to:

- classify the different types of risks;

- identify risks in scope;

- assess risks;

- identify possible interventions and relative priorities;

- select, plan and implement interventions, managing actions and collecting feedbacks.

While studies and standards on risk management for health and safety, environment or security of information defined a well-known and universally recognized state of the art, corporate and operational risk management already needs a systematic approach and a common view. The main contributions in these fields are the reference models issued by international bodies2, 3, 4, 5.

Starting from the most advanced international experiences, in this chapter some principles are defined and developed in a framework that, depending on the maturity level of organizations, may help to adequately support their achievements and drive operations performance.

- 1841 reads