In order to be successful in business, we must understand what our customer’s needs and wants are and deliver them in an efficient and profitable manner. In order to do so, we must also understand the industries in which the companies are immersed and what makes them attractive from the general point of view.

Industry attractiveness was initially described by Michael Porter in his book, Competitive Strategy (Porter 1980). Porter’s well-known Five Forces Model is often used as an analytical tool by companies when they are deciding whether or not to enter a particular industry. According to Porter, what makes an industry attractive or unattractive is determined by 5 forces:

- Rivalry: This force is measured by how intense the rivalry/competition relationship in an industry is. The factors affecting rivalry are: number of competitors, slow market growth, low levels of product differentiation, how aggressive competing companies are, etc. For example, retailing has always had the reputation of being a highly competitive industry, while the rail road industry is thought to be less competitive.

- Threat of substitutes: In Porter's model, substitute products refer to products that can be substituted for your own. Substitute products can be found within own or other industries. For example, if you decide to start an inter-city bus company, you have to consider all the other options your customers have to get from one city to another, for instance, city trains, small shuttle service, shared private cars, among others.

- Buyer power: The power of buyers is the impact that customers have on a producing industry. In general, when buyer power is strong, the buyer has the ability to set the price because usually there are very few buyers and many suppliers. Grain farmers are often used as an example. In most countries, there are many small farmers who grow grain, but few large buyers who have the power to set the price a farmer receives.

- Barriers to entry: Barriers to entry are unique offerings of companies in an industry that any company wishing to enter that industry must be prepared to overcome. Examples from developed economies are online banking and ATM services for banks and frequent flyer programs for airlines. In many cases, development of these expected products or services is quite expensive for a new entrant, and, thus, it s a barrier to entry.

- Supplier power: Suppliers are powerful when there are few suppliers for a company to purchase necessary items from. In a situation where there are few suppliers, it is typically difficult for a buyer to get a lower price from another supplier. An example is the oil industry, where they are many buyers, but relatively few suppliers, and most of the suppliers are members of the OPEC cartel which sets common production quotas, thereby controlling the market price for oil.

Michael Porter developed two other tools that are widely used by organizations in their approach to markets: Three Generic Strategies and the Value Chain.

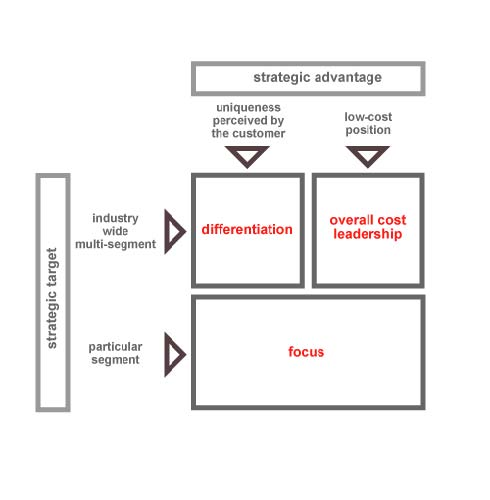

Porter postulated that a firm should adopt only one of three generic strategies. They are illustrated in Figure 3.4.

A firm can choose to be the low cost producer for a wide segment of the market; it can offer a differentiated product for a wide segment that customers are willing to pay more for because of its perceived greater value; or it can focus on a market niche as a low cost producer or with a differentiation strategy. For example, the original Volkswagen automobile focused in a broad low-cost market. As a matter of fact, the word in German means “Peoples Car”, indicating it was meant to be affordable by everyone. A good example of a differentiated automobile is the BMW. People pay more for a BMW because of the “conspicuous consumption” or “luxury badging aspects” they have managed to create in peoples’ minds, not necessarily because the BMW is actually worth 30 per cent more than a comparable automobile from Cadillac or Nissan. An example of a car positioned towards a low cost niche is the Mazda Miata, a two-seat sports car that costs much less than comparable cars. Finally, you can consider the Hummer as a car that appeals to a differentiated market niche.

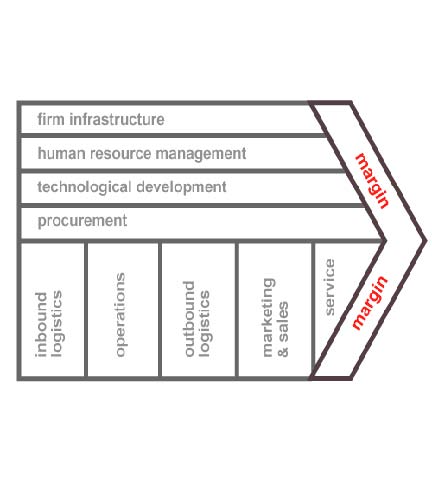

Porter’s other widely-used tool is the Value Chain, which is used to model the firm as a chain of value-creating activities or processes. Porter identified a set of interrelated generic processes common to a wide range of firms. He divided them into primary activities and support activities, as illustrated in Figure 3.5.

The primary activities in the value chain are: inbound logistics, operations, outbound logistics, marketing and sales, and service. The support activities are procurement, technology development and research and development, human resource management, and firm infrastructure (top management). The primary value chain activities are interrelated, to the extent that they can be formed with high quality and low cost, the firm will be able to have value-added that will be returned to the firm as profit. As an example of the way that primary value activities are interrelated, suppose that the inbound logistics process does not do well in identifying raw materials of poor quality. This will cause problems with the next process, operations, and it may cause problems as far down the value chain as service after the sale. The value chain is, thus, a useful tool for analysing a company’s business processes and searching for ways to lower costs, improve efficiency or search for process innovations.

- 37467 reads