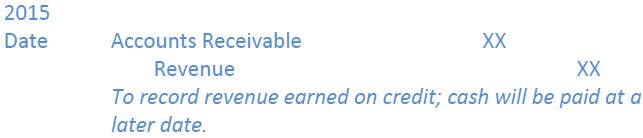

Revenue recognition is the process of recording revenue in the accounting period in which it was earned; this is not necessarily when cash is received. Most corporations assume that revenue has been earned at a consistent point in the accounting cycle. For instance, it is often convenient to recognize revenue at the point when a sales invoice has been sent to a customer and the related goods have been shipped or services performed. This point can occur before receipt of cash from a customer, creating an asset called Accounts Receivable. This concept was illustrated in Transaction 8 in Chapter 2. The general form of the journal entry is as follows, based on the format for entries in the general journal discussed in the prior chapter:

When cash payment is later received, the asset Accounts Receivable is exchanged for the asset Cash and the following entry is made:

Revenue is recognized in the first entry (the credit to revenue), prior to the receipt of cash. The second entry has no effect on revenue.

When cash is received at the same time that revenue is recognized, the following entry is made:

Transaction 8 in Chapter 2 illustrated these two possibilities.

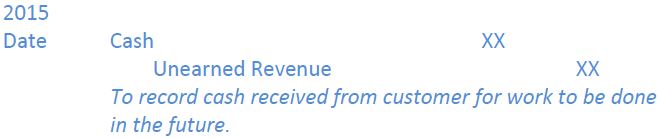

When a cash deposit or advance payment is obtained before revenue is earned, a liability called Unearned Revenue is recorded as follows:

Transaction 7 in Chapter 2 illustrated this. There is no effect on the income statement at this point. Revenue is recognized only when the services have been performed. At that time, the following entry is made:

This entry reduces the unearned revenue account by the amount of revenue earned. At this point, revenue is recognized in the income statement account called Repair Revenue.

The matching of revenue to a particular time period, regardless of when cash is received, is an example of accrual accounting. Accrual accounting is the process of recognizing revenues when earned and expenses when incurred regardless of when cash is exchanged. Accrual accounting is an important generally accepted accounting principle. It allows revenue and expenses to be matched to the applicable time period, regardless of when cash receipts or outlays occur. Recognition of expenses is discussed in the next section.

- 2323 reads