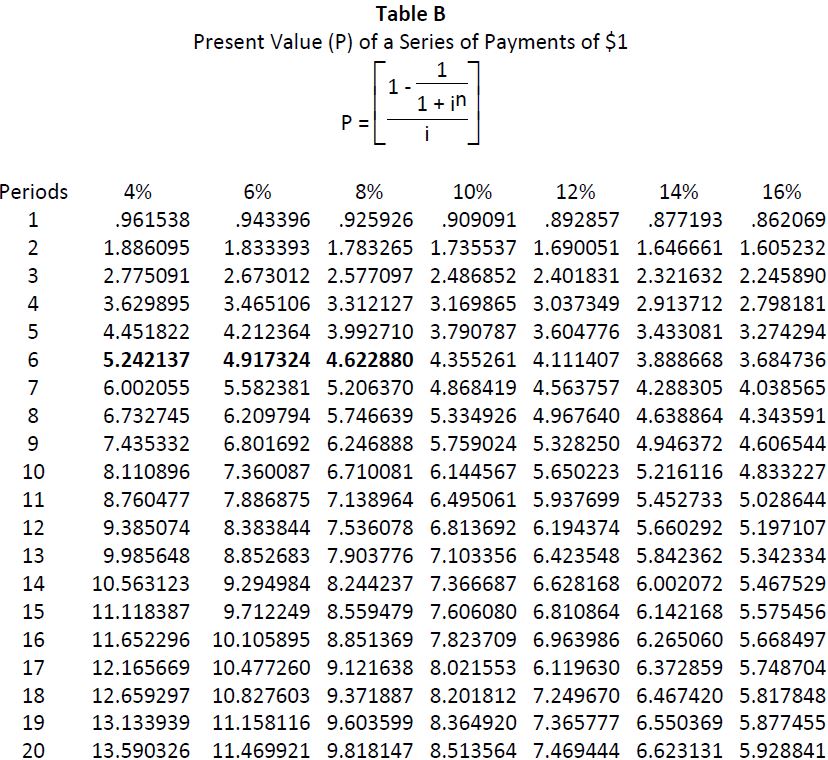

The present value of the interest payments can be calculated using table B. This formula is just the sum of the present value of each of the six interest payments made at varying points over the three-year life of the bonds. In this instance, interest of $6,000 is paid semi-annually for 6 periods on the bonds. Since BDCC’s payments are made semiannually, the rate used is half the prevailing market rate of interest.

Scenario 1: The Market Interest Rate Is 12% (per Year)

According to table B, the sum of the present values of six regular payments of $1 compounded at 6% (l2% x ½) for six periods is 4.917324 (see bolded amount in 6% column). The total present value of the six, $6,000 interest payments made over the three-year life of the BDCC bonds under scenario 1 is therefore $6,000 x 4.917324 = $29,504.

Scenario 2: The Market Interest Rate Is 8% (per Year)

Again using table B, the sum of the present values of six regular interest payments of $1 compounded at 4% (8% x ½) for 6 periods is 5.242137 (see bolded amount in 4% column). The total present value of the six, $6,000 interest payments made over the three-year life of the BDCC bonds under scenario 2 is therefore $6,000 x 5.242137 = $31,453.

Scenario 3: The Market Interest Rate Is 16% (per Year)

The sum of the present values of six regular interest payments of $1 compounded at 8% (16% x ½) for 6 periods is 4.622880 according to table B. The total present value of the six, $6,000 interest payments made over the three-year life of the BDCC bonds under scenario 3 is therefore $6,000 x 4.622880 = $27,737.

- 2030 reads