| LO1 – Explain the purpose of the statement of cash flows. |

Cash flow is an important factor in determining the success or failure of a corporation. It is quite possible for a profitable business to be short of cash. A company can have liquidity issues because of large amounts of cash tied up in inventory and accounts receivable, for instance. Conversely, an unprofitable business might have sufficient cash to pay its bills if it has access to enough bank financing or if it can issue additional shares.

The financial activities of a corporation are reported through four financial statements: a balance sheet, an income statement, a statement of changes in equity, and a statement of cash flows. This chapter discusses the statement of cash flows in detail.

The statement of cash flows provides a detailed summary of where cash came from during the accounting period and how cash was used. The SCF explains why cash on hand at the end of the accounting period is different from the cash on hand at the beginning of the period by describing the enterprise’s operating, financing and investing activities on a company’s cash resources.

Cash flow information is useful to management when making decisions such as purchasing equipment, plant expansion, paying down long–term debt, or declaring dividends. The SCF is useful to external users when evaluating a corporation’s financial performance.

Provision of information useful for assessing the timing, amount, and uncertainty of future cash flows is a primary objective of financial reporting. Using the SCF, analysts examine the relationship among the various sources and uses of cash during the period to help predict future cash flows.

The SCF, together with the income statement, provides a somewhat limited means of assessing future cash flows because these statements are based on historical, not prospective data. Nevertheless, the ability to generate cash from past operations is often an important indication of whether the enterprise will have difficulty meeting obligations as they fall due, paying dividends, paying for recurring operating costs, or surviving adverse economic conditions.

“Cash” consists of anything a bank will accept for deposit. However, for SCF purposes, cash can also include cash equivalents—assets that can be quickly converted into a known amount of cash, such as short-term investments that are not subject to significant risk of changes in value.

For our purposes, an investment will be considered a cash equivalentwhen it has a maturity of three months or less from the date ofacquisition.

Conversely, there are examples of “negative” cash, like bank overdrafts. An overdraft occurs when a corporation is allowed to pay out more cash from its bank account than it has on deposit, with the understanding that the overdraft situation is temporary and limited to a predetermined amount. Another example is a demand bank loan. This is a short-term “demand” loan that provides cash to a company when needed. However, the bank can require that the loan be repaid at any time.

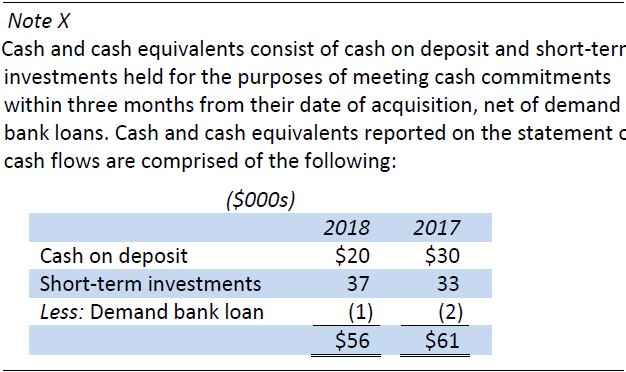

Because of differences in the nature of each entity and industry, management judgement is required to determine what assets constitute cash and cash equivalents for a particular firm. This decision needs to be disclosed on the SCF or in a note to the financial statements. For instance, the following note disclosure could be made:

Cash flows result from a wide variety of a corporation’s activities as cash is received and disbursed over a period of time. Because the income statement is based on accrual accounting that matches expenses with revenues, net income usually is not the same as cash receipts and disbursements occurring during the same time period. As we will see, the statement of cash flows converts accrual-based net income into cash flow from operating activities.

- 2372 reads