Plant and equipment assets, also known as long-lived assets, are expected to generate revenues over the current and future accounting periods because they are used to produce goods, supply services, or used for administrative purposes. The truck and equipment purchased by Big Dog Carworks Corp. in January are examples of assets that provide economic benefits for more than one accounting period. Because of this, their costs also must be spread over the same time period, or useful life. Useful life is an estimate of how long the asset will be used to produce benefits for the business. This is done to satisfy the matching principle. For example, the $100,000 cost of a machine expected to be used over five years is not expensed entirely in the year of purchase because the benefits it provides will last for several years. Immediately expensing the purchase would cause expenses to be overstated in Year 1 and understated in Years 2, 3, 4, and 5. More appropriately, the $100,000 cost should be spread over the asset’s five-year useful life.

The process of allocating the cost of a long-lived asset over the period of time it is expected to be used is called depreciation. Various depreciation methods and considerations are discussed in a later chapter.

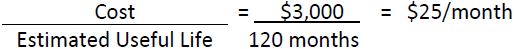

For our purposes here, the benefit of plant and equipment that is used up each month will be calculated as its cost divided by its estimated useful life, calculated in months.

Let’s work through two examples to demonstrate depreciation adjustments. Recall that in January, BDCC purchased two assets – equipment and a truck. Assume that they are considered long-lived asset because they have an estimated useful life greater than one year. The equipment was purchased for $3,000 (Transaction 3, Chapter 2). If its actual useful life is 10 years (120 months), monthly depreciation expense is $25, calculated as:

The following adjusting entry is made in the records of BDCC on January 31:

Notice that the credit side of the entry is not made to the Equipment account. Rather, a contra account called “Accumulated Depreciation – Equipment” is used. A contra account is a general ledger account that is related to another account (in this case, Equipment). It has a credit balance, which is subtracted from the debit balance of its related account on the financial statements. Accumulated depreciation is a contra account that records the amount of a particular asset’s cost that has been expensed since it was put into use. The original cost of the long-lived asset needs to be maintained in the accounting records in case it is sold. Maintaining a separate accumulated depreciation contra account allows this original cost to be retained in the records.

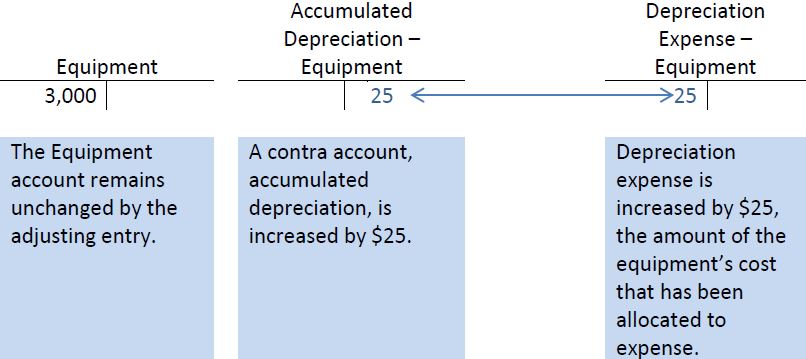

When this adjusting entry is posted, the accounts appear as follows:

For financial statement reporting, the asset and contra asset accounts are combined. This carrying amount or net book value of the equipment on the balance sheet is shown as $2,975 ($3,000 – $25) at January 31, like this:

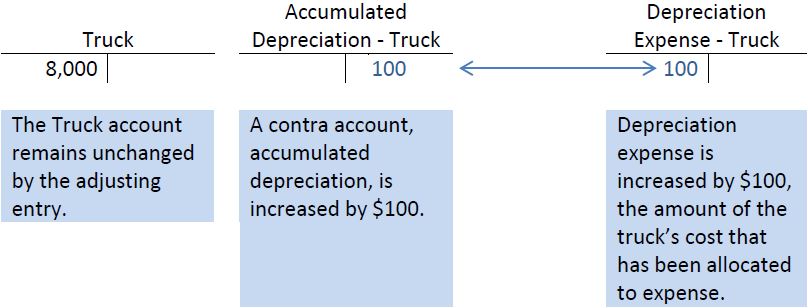

Recall that BDCC also purchased a truck for $8,000 during January (Transaction 4, Chapter 2). Assume the truck has an estimated useful life of 80 months. At January 31, one month of the truck cost has expired. Depreciation is calculated as:

The adjusting entry recorded on January 31 is:

When the adjusting entry is posted, the accounts appear as follows:

The value of the truck on the balance sheet at January 31 is shown as $7,900 ($8,000 – $100), like this:

Although land is a long-lived asset, it is not depreciated because its benefits do not decrease over time. Therefore, land is often referred to as a non-depreciable asset.

- 2295 reads