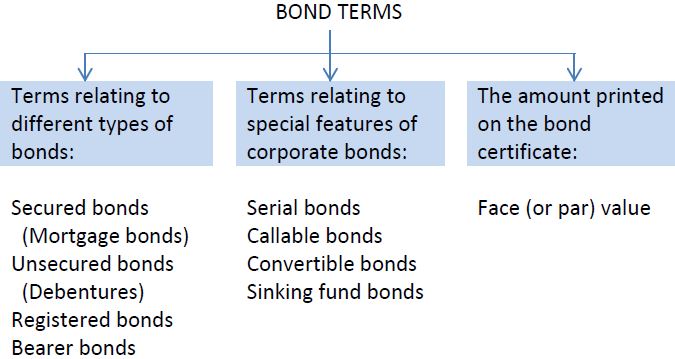

There are three main categories of bond terms. These are shown in Figure 10.1.

Each corporation issuing bonds has unique financing needs and attempts to satisfy various borrowing situations and investor preferences. Many types of bonds have been created to meet these varying needs. Some of the common types are described below.

Secured bonds are backed by physical assets of the corporation. These are usually long-lived assets. When real property is legally pledged as security for the bonds, they are called mortgage bonds.

Unsecured bonds are commonly referred to as debentures. A debenture is a formal document stating that a company is liable to pay a specified amount with interest. The debt is not backed by any collateral. As such, debentures are usually only issued by large, well-established companies. Debenture holders are ordinary creditors of the corporation. These bonds usually command a higher interest rate because of the added risk for investors.

Registered bonds require the name and address of the owner to be recorded by the corporation or its trustee. The title to bearer bondspasses on delivery of the bonds to new owners and is not tracked. Payment of interest is made when the bearer clips coupons attached to the bond and presents these for payment.

Special features can be attached to bonds in order to make them more attractive to investors.

When serial bonds are issued, the bonds have differing maturity dates, as indicated on the bond contract. Investors are able to choose bonds with a term that agrees with their investment plans. For example, in a $30 million serial bond issue, $10 million worth of the bonds may mature each year for three years.

The issue of bonds with a call provision permits the issuing corporation to redeem, or call, the bonds before their maturity date. The bond indenture usually indicates the price at which bonds are callable. Corporate bond issuers are thereby protected in the event that market interest rates decline below the bond contract interest rate. The higher interest rate bonds can be called to be replaced by bonds bearing a lower interest rate.

Some bonds allow the bondholder to exchange bonds for a specified type and amount of the corporation’s share capital. Bonds with this feature are called convertible bonds. This feature permits bondholders to enjoy the security of being creditors while having the option to become shareholders if the corporation is successful.

When sinking fund bonds are issued, the corporation is required to deposit funds at regular intervals with a trustee. This feature ensures the availability of adequate cash for the redemption of the bonds at maturity. The fund is called “sinking” because the transferred assets are tied up or “sunk,” and cannot be used for any purpose other than the redemption of the bonds.

The corporation issuing bonds may be required to restrict its Retained Earnings, thereby limiting the amount of dividends that can be paid and protecting bondholders..

Investors consider the interest rates of bonds as well as the quality of the assets, if any, that are pledged as security. The other provisions in a bond contract are of limited or no value if the issuing corporation is in financial difficulties. A corporation in such difficulties may not be able to sell its bonds, regardless of the attractive provisions attached to them.

Each bond has an amount printed on the face of the bond certificate. This is called the face value of the bond; it is also commonly referred to as the par-value of the bond. When the cash received is the same as a bond’s face value, the bond is said to be issued at par. A common face value of bonds is $1,000, although bonds of other denominations exist. A $30 million bond issue can be divided into 30,000 bonds, for example. This permits a large number of individuals and institutions to participate in corporate financing.

- 4868 reads