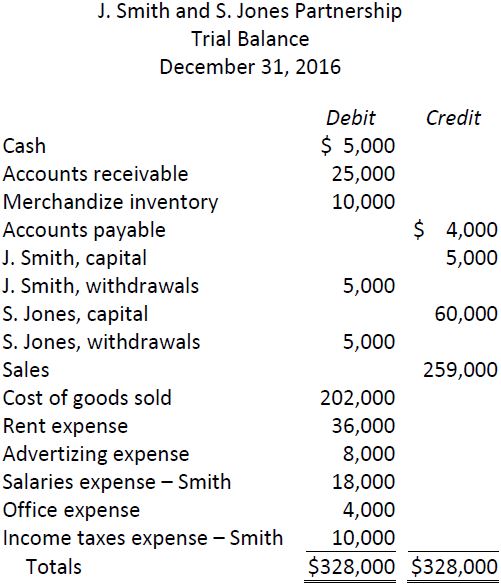

You are given the following data for the partnership of J. Smith and S. Jones.

Smith is involved in the day-to-day operations of the business. Jones provides most of the cash contributions when needed. Smith pays himself $1,500 per month as a “salary” though the partners have agreed to share profits and losses equally. Jones contributed $20,000 capital during the year. The opening credit balance in the capital accounts was Smith $5,000 and Jones $40,000.

|

Required: |

|

|

1. |

Prepare an income statement for the year. |

|

2. |

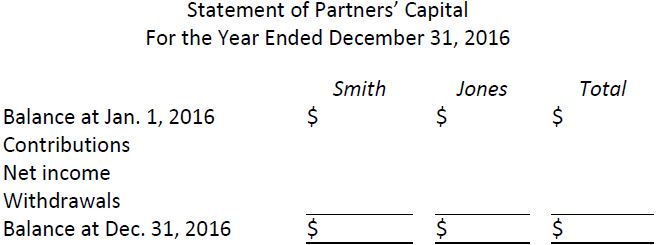

Prepare a statement of partners’ capital for the year in the following format and comment on the results: |

|

3. |

Prepare a balance sheet at December 31, 2016. |

|

4. |

Prepare closing entries at year-end. |

- 1812 reads