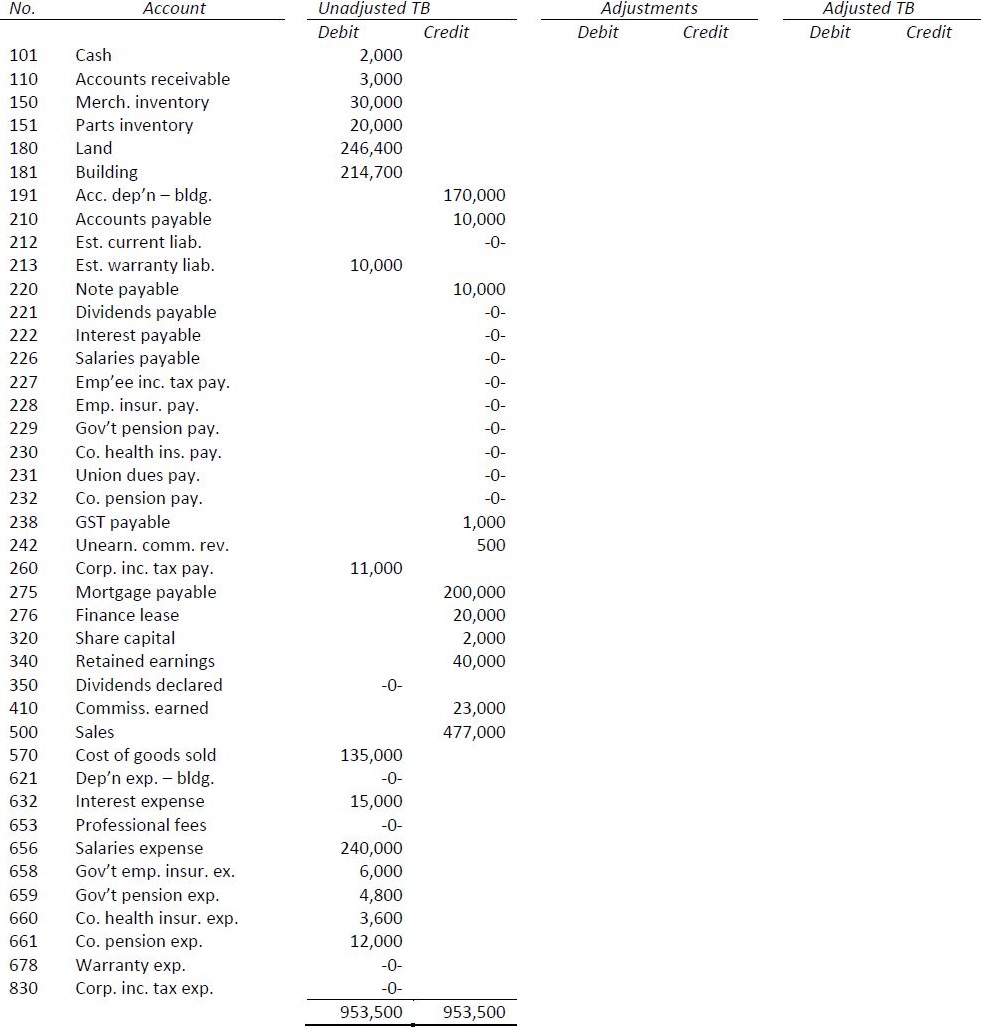

The following unadjusted trial balance has been taken from the records of Rockfish Rentals Corp at December 31, 2015:

The company uses the perpetual inventory method. GST applies only when indicated. The following additional information is available:

a. Unearned commission revenue at December 31 is $800.

b. A $1,000 invoice for parts was received from a supplier at December 31 that has not yet been recorded. GST of 5% was added to the cost of parts, for a total of $1,050.

c. A December 31 sale on account for $3,000 was not recorded. GST of 5% was also charged on the sale. Related cost of goods sold was $2,500.

d. The $10,000 note payable was issued on December 1, 2015. It bears interest at 4% per year and is due November 30, 2016. No interest expense has been recorded.

e. A warranty repair has not been correctly recorded at December 31. $500 of parts was recorded incorrectly as cost of goods sold, and salary expenditures of $100 were recorded incorrectly as salaries expense.

f. Warranty expense for the year is estimated at 3% of sales revenue.

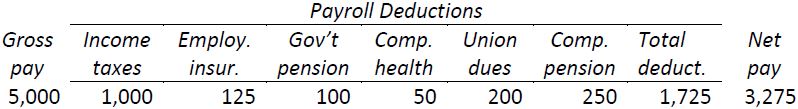

g. Unpaid salaries for the week of December 24-31 were as follows:

| The company’s portion of contributions is: | ||

| Government employment insurance | 1.4 times | |

| Government pension | 1 time | |

| Company health insurance | 1.5 times | |

| Company pension | 2 times | |

h. Audit fees for the 2015 financial statements are estimated to be $5,000. The auditor will add GST to the amount that is eventually billed.

i. Payments on the mortgage and finance lease, including interest, were made on December 31. Payments during 2016 will be made as follows:

| Interest | Reduction of principal | Total payments | |

| Mortgage | $7,000 | $3,000 | $10,000 |

| Finance lease | 1,500 | 2,500 | 4,000 |

j. It is possible that the company will lose a lawsuit filed against it during the year. The estimated award is $5,000.

k. Depreciation on the building is calculated on the double-declining balance basis. The useful life is ten years. Residual value is $5,000. There were no additions or disposals during the year.

l. Share capital of $500 was issued for cash on August 31 and is included in the accounting records.

m. The corporate income tax rate is 20% calculated on income before income taxes.

n. Dividends of $2,000 were declared on December 31, 2015. These will be paid on January 31, 2016.

Required:

- Prepare necessary adjusting entries at December 31, 2015. Include general ledger account numbers and appropriate descriptions.

- Post the entries to the “Adjustments” column of the worksheet. Total the worksheet.

- Prepare a classified income statement and statement of changes in equity for the year ended December 31, 2015 and a classified balance sheet at December 31.

- Assume the salaries, employee deductions, and company payroll expenses were paid on January 5, 2016. Record the journal entries. Assume payments were made as applicable to employee J. Smith, Government of Canada, Union Local 151, Purple Cross Healthcare, and Fidelity Mutual Pension Administration.

- Assume amounts owing for 2015 corporate income taxes payable and GST payable are remitted in cash to the Government of Canada on January 15, 2016. Record the journal entries.

- Assume the estimated warranty liability reported on the December 31, 2014 balance sheet was $30,000. Should this be a concern when Rockfish management reviews the 2015 financial statements?

- What types of information should be disclosed in the notes to the financial statements related to the various liability accounts?

- 2293 reads