Creditors are interested in evaluating a company’s financial performance, in order to project whether the firm will be able to pay interest on borrowed funds and repay the debt when it comes due. Creditors are therefore interested in measures such as the timesinterest earned ratio. This ratio indicates the amount by which income from operations could decline before a default on interest may result. The ratio is calculated by the following formula:

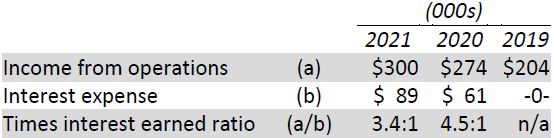

Note that income from operations is used, so that income before deduction of creditor payments in the form of income taxes and interest is incorporated into the calculation. BDCC’s 2020 and 2021 ratios are calculated as follows:

The larger the ratio, the better creditors are protected. BDCC’s interest coverage has decreased from 2020 to 2021 (3.37 times vs. 4.49 times), but income would still need to decrease significantly for the company to be unable to pay its obligations to creditors. The analysis does indicate, though, that over the past two years interest charges have increased compared to income from operations. Creditors need to assess company plans and projections, particularly those affecting income from operations, to determine whether their loans to the company are at risk. As discussed above, it may be that significant investments in assets have not yet generated related increases in sales and income from operations.

- 2388 reads