LO1 – Explain how adjusting entries match revenues and expenses tothe appropriate time period.

Financial statements must be prepared in a timely manner, at minimum, once per fiscal year. For statements to reflect activities accurately, revenues and expenses must be recognized and reported in the appropriate accounting period. In order to achieve this type of matching, adjusting entries need to be prepared.

LO2 – Explain the use of and prepare the adjusting entries requiredfor prepaid expenses, depreciation, unearned revenues,accrued revenues, and accrued expenses.

Adjusting entries are prepared at the end of an accounting period. They allocate revenues and expenses to the appropriate accounting period regardless of when cash was received or paid. The five types of adjustments are:

LO3 – Prepare an adjusted trial balance and explain its use.

The adjusted trial balance is prepared using the account balances in the general ledger after adjusting entries have been posted. Debits must equal credits. The adjusted trial balance is used to prepare the financial statements.

LO4 – Use an adjusted trial balance to prepare financial statements.

Financial statements are prepared based on adjusted account balances.

LO5 – Identify and explain the steps in the accounting cycle.

The steps in the accounting cycle are:

|

Steps occurring continually during the fiscal year: |

||

|

1. |

Transactions are analyzed and recorded in the general journal. |

|

|

2. |

The journal entries in the general journal are posted to accounts in the general ledger. |

|

|

Steps occurring whenever interim or year-end financial statements areprepared at the end of an accounting period |

||

|

3. |

An unadjusted trial balance is prepared to ensure total debits equal total credits. |

|

|

4. |

The unadjusted account balances are analyzed, and adjusting entries are journalized in the general journal and posted to the general ledger. |

|

|

5. |

An adjusted trial balance is prepared to prove the equality of debits and credits. |

|

|

6. |

The adjusted trial balance is used to prepare financial statements. |

|

|

Steps occurring only at the fiscal year-end |

||

|

7. |

Closing entries are journalized and posted. |

|

|

8. |

A post-closing trial balance is prepared. |

|

LO6 – Explain the purpose of closing entries and use closing entries toprepare a post-closing trial balance.

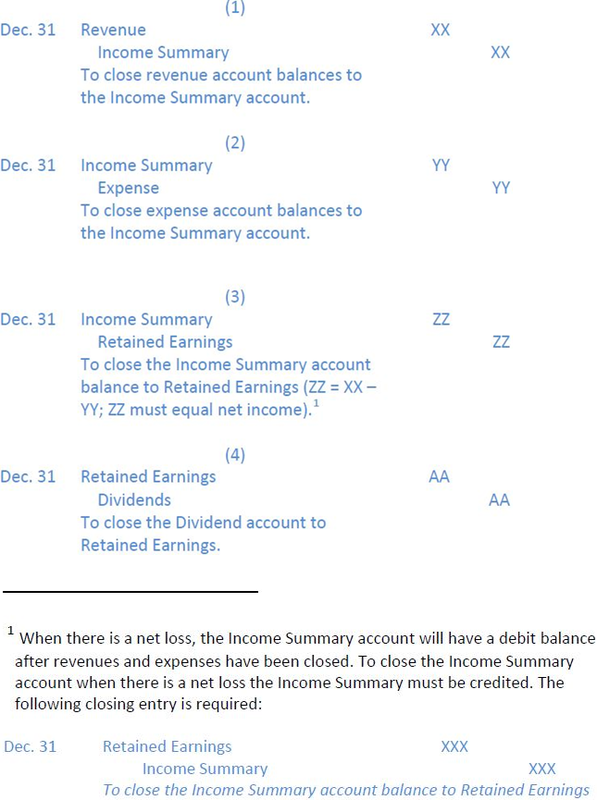

After the financial statements have been prepared, the temporary account balances (revenues, expenses, and dividends) are transferred to retained earnings, a permanent account, via closing entries. The result is that the temporary accounts will have a zero balance and will be ready to accumulate transactions for the next accounting period.

The general forms of the four closing entries are:

The post-closing trial balance is prepared after the closing entries have been posted to the general ledger. The post-closing trial balance will contain only permanent accounts because all the temporary accounts have been closed.

- 4315 reads