| LO5 – Explain and record short-term notes receivable and calculate related interest. |

Notes receivable are formalized accounts receivable. They are recorded as current assets if they are due within twelve months of the date of issue. A note receivable is a signed, legally-enforceable document. The customer who owes the money promises to pay the company the principal plus interest on the due date. The principal is the amount of the account receivable. Interest is calculated as: (principal × annual Interest rate × length of time outstanding).

Notes receivable can arise at the time of sale or when a customer’s account receivable becomes overdue. For example, assume that BDCC provided $4,000 of services to customer Woodlow on August 1, 2015, but this amount is still unpaid at November 30. Because of the length of time that has elapsed, BDCC and the customer agree to sign a 4%, 3- month note receivable on December 1. The journal entry on August 1 would be:

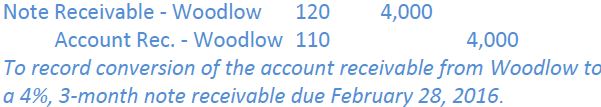

Then entry on December 1 to record the conversion of the account receivable to a note receivable would be:

If a year-end occurred on December 31, 2015, an adjusting entry would be made to record accrued interest from December 1 to December 31:

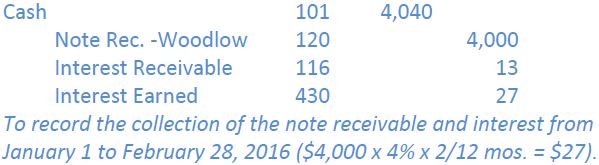

The maturity date is three months from the date of issue, or February 28, 2016. On that date, BDCC would record the collection of the note receivable and related interest as:

- 2266 reads