| LO2 – Describe how bonds, premiums and discounts are recorded in the accounting records and disclosed on the balance sheet. |

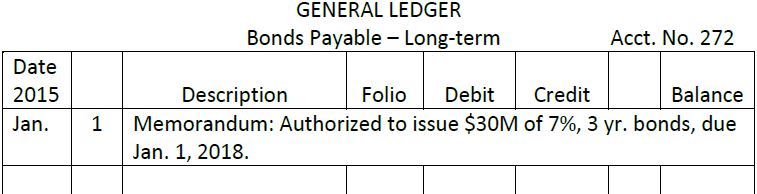

Assume that Big Dog Carworks Corp. decides to issue $30 million of 7% bonds to finance its expansion. The bonds are repayable three years from the date of issue, January 1, 2015. The amount of authorized bonds, their interest rate, and their maturity date can be shown in the general ledger as follows:

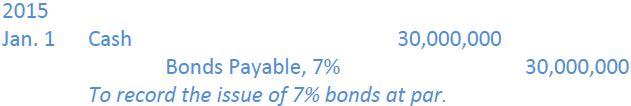

If the bonds are also sold at face value the same day, the journal entry is straight forward:

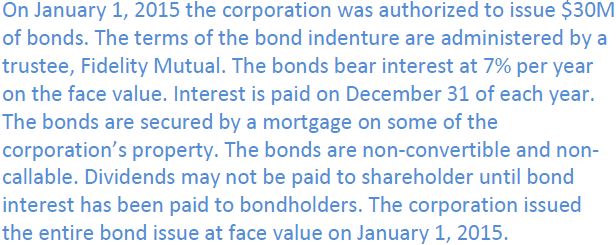

Although different bond issues may be combined and disclosed on the balance sheet as one amount, the characteristics of each bond issue are disclosed in a note the financial statements. This includes the interest rate and maturity date of the bond issue. Also disclosed in a note are any restrictions imposed on the corporation’s activities by the terms of the bond indenture and the assets pledged, if any.

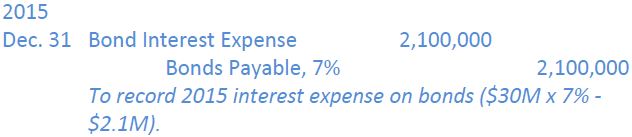

If interest is paid once a year on December 31, the 2015 entry would be:

The partial balance sheet of BDCC at December 31, 2015 would show:

Note X could state:

- 2175 reads