Before considering the differences in record keeping for incorporated and unincorporated businesses, we will examine the differences in the balance sheet reporting for each type of organization. The example below shows the owners’ equity section of the balance sheet for three businesses that have identical financial positions. Although the asset and liability presentation is the same, the presentation of the equity section differs in each case, as follows:

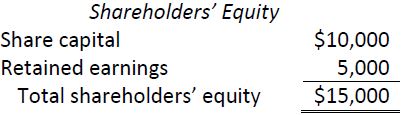

a. Corporation

b. Proprietorship

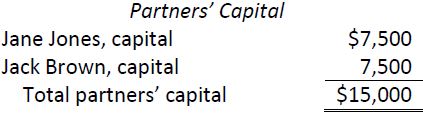

c. Partnership

As discussed before, the shareholders’ equity section of a corporation’s balance sheet is divided into two categories – share capital and retained earnings. The first category represents the owner’s investments in shares of the company. The second category is the accumulated earnings of the corporation less any dividends paid to owners from commencement of operations.

For a partnership, and similar to that of a proprietorship, each owners’ equity is shown as individual Partner’s Capital accounts . The capital account reflects each partner’s capital contributions to the business, the partner’s share of accumulated earnings, and any withdrawals by the particular partner.

Business transactions for a partnership are recorded in the same manner as those for a proprietorship. Distributions are recorded in a Partner’s Withdrawals account. Individual capital and withdrawal accounts are maintained for each partner in the general ledger. The withdrawals account balance is closed to each partner’s capital account at the end of the accounting time period.

- 3056 reads