The total present value of the $100,000 BDCC bonds issued under each of the three scenarios is the sum of the present value of the principal and interest payments derived above.

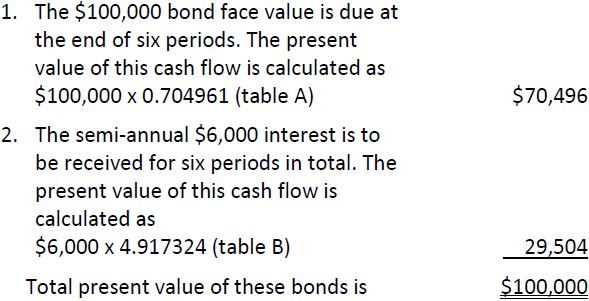

Scenario 1: The Bond Contract Interest Rate (12%) Is the Same as theMarket Interest Rate (12%)

In this case, the bonds are sold at face value. An investor is willing to pay face value because the present value of the future cash payments is $100,000 – the sum of the present value of the principal and interest payments of the bonds:

When the bond contract interest rate is the same as the market interest rate, the present value of all cash flows is the same as the bond’s face value. In actual practice, however, the market interest rate may be different from the bond indenture interest rate because of the time that elapses between the creation of the indenture and the time the bonds are actually sold on the bond market. Scenarios 2 and 3 deal with this situation.

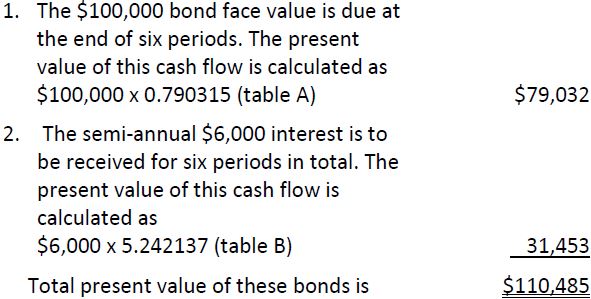

Scenario 2: The Bond Contract Interest Rate (12%) Is Greater than theMarket Interest Rate (8%)

Here the bonds are sold at a premium. An investor is willing to pay more than face value because the present value of the future cash flow amounts to $110,485, calculated as follows:

Therefore, when the bond contract interest rate is greater than the market interest rate, the present value of principal and interest payments is greater than the face value of the bonds, other things being equal. This excess amount of $10,485 ($110,485 – 100,000) is the premium that was assumed in the original scenario 2 example.

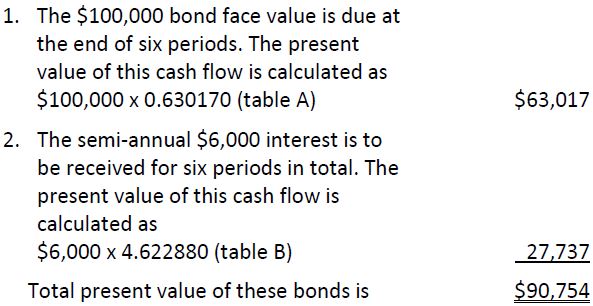

Scenario 3: The Bond Contract Interest Rate (12%) Is Less than theMarket Interest Rate (16%)

In this case, the bonds are sold at a discount. An investor will pay less than face value because the present value of future cash flow amounts to only $90,754.

Therefore, when the bond contract interest rate is less than the market interest rate, the present value of all cash flows is less than the face value of the bonds. This difference, calculated as $9,246 ($100,000 - $90,754) in this example, is the discount used in the original scenario 3 discussed earlier in the chapter.

- 2225 reads