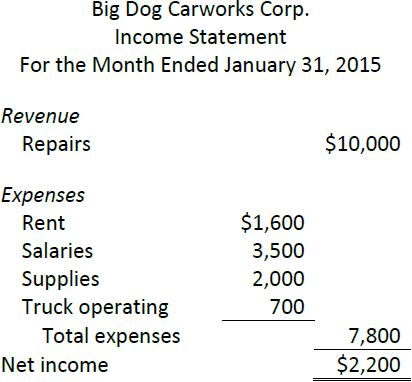

Recall that the income statement summarizes a company’s revenues less expenses over a period of time. An income statement for BDCC was presented in the first few pages of Chapter 1:

The format used above was sufficient to disclose relevant financial information for Big Dog’s simple start-up operations. When operations become more complex, an income statement can be classified like the balance sheet. The classified income statement will be discussed in detail in a later chapter.

Regardless of the type of financial statement, any items that are material must be disclosed separately so users will not otherwise be misled. A material amount is one which would affect the decision of a reader if it was omitted. Materiality is a matter for judgment. Office supplies of $1,000 per month used by BDCC in January 2015 in its first month of operations might be a material amount and therefore disclosed as a separate item on the income statement for the month ended January 31, 2015. If annual revenues grew to $1 million several years later, $1,000 per month for supplies might be considered immaterial. These expenditures would then be grouped with other similar items and disclosed as a single amount on the income statement.

- 6810 reads