| LO2 – Evaluate relative financing effects of bonds, common shares, and preferred shares. |

Many factors influence management in its choice between the issue of debt and the issue of share capital. One of the most important considerations is the potential effect of each of these financing methods on the present shareholders.

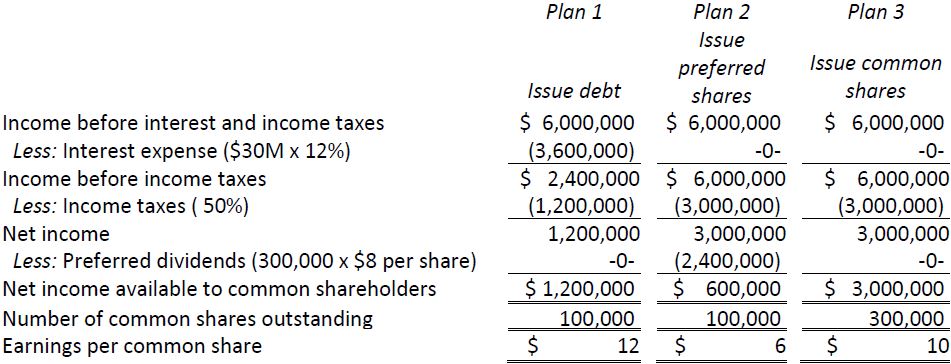

Consider the example of Old World Corporation, which has 100,000 common shares outstanding, is a growth company, and is profitable. Assume Old World requires $30 million in cash to finance a new plant. Management is currently reviewing three financing options:

- Issue 12% debt, due in three years

- Issue 300,000 preferred shares (dividend $8 per share annually)

- Issue an additional 200,000 common shares at $30 each.

Management estimates that the new plant should result in income before interest and income taxes of $6 million. The income tax rate is 50%. Management has prepared the following analysis to compare and evaluate each financing option.

Plan 1, the issue of debt, has several advantages for existing common shareholders.

Advantage 1: Earnings per share

If the additional long-term financing were acquired through the issue of debt, the corporate earnings per share (EPS) on each common share would be $12. This EPS is greater than the EPS earned through financing with either preferred shares or additional common shares. On this basis alone, the issue of debt is more financially attractive to existing common shareholders.

Advantage 2: Control of the corporation

Creditors have no vote in the affairs of the corporation. If additional common shares were issued, there might be a loss of corporate control by existing shareholders because ownership would be distributed over a larger number of shareholders, or concentrated in the hands of one or a few new owners. In the Old World case, issuing common shares would increase the number threefold from 100,000 to 300,000 shares.

Advantage 3: Income taxes expense

Interest expense paid on debt is deductible from income for income tax purposes. Dividend payments are distributions of retained earnings, which is after-tax income. Thus, dividends are not deductible again for tax purposes. With a 50% income tax rate, the after-tax interest expense to the corporation is only 6% (12% x 50%). The effective interest rate on preferred shares in this example is much higher, at 40% ($8/$20).

- 2400 reads