Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

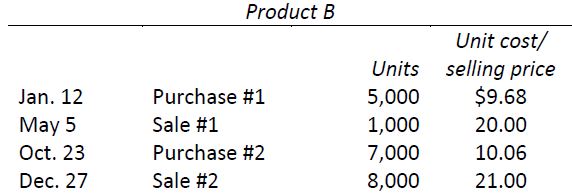

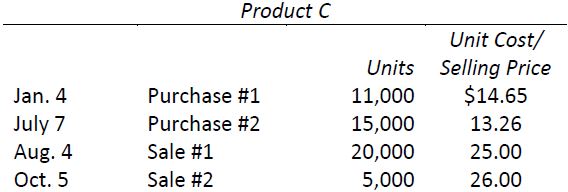

American Depress Limited made the following purchases and sales of Products A, B and C during the year ended December 31, 2016:

Opening inventory at January 1 amounted to 4,000 units at $11.90 per unit for Product A, 5,000 units at $9.54 per unit for Product B, and 6,000 units at $14.71 per unit for Product C.

Required:

- Prepare inventory record cards for Products A, B, and C for the year using the FIFO inventory cost flow assumption.

- Calculate total cost of ending inventory at December 31, 2016.

- Assume now that American Depress keeps over 1,000 types of inventory on hand. Why might staff prefer to use computerized accounting software if a perpetual inventory system is used?

- 2077 reads