| LO8 - Explain goodwill and identify where on the balance sheet it is reported. |

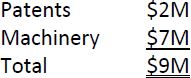

Assume that Big Dog Carworks Corp. purchases another company for $10 million ($10M). BDCC takes over all operations, including management and staff. There are no liabilities. The fair values of the purchased assets consist of the following:

Why would BDCC pay $10M for assets with a fair value of only $9M? The extra $1M represents goodwill. Goodwill is the excess paid over the fair value of the net assets when one company buys another. It is an estimate of the ability of the company to generate superior earnings in the future compared to other companies in the same industry.

Goodwill is the combination of the acquired company’s assets which cannot be separately identified—such as a well-trained workforce, better retail locations, superior products, or excellent senior managers—the value of which is recognized only when a significant portion of the business is purchased by another company.

Recall that among other characteristics, intangible assets must be separately identifiable. Because components of goodwill are not separately identifiable, goodwill is not considered an intangible asset. However, it does have future value and therefore is recorded as a long-lived asset under its own heading of “Goodwill” on the balance sheet.

- 2015 reads