Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

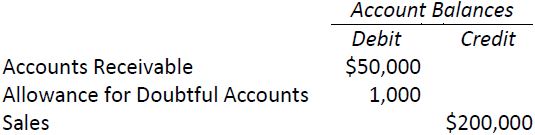

Elliot Inc. has the following unadjusted account balances at December 31, 2015:

Required:

- Assume Elliot estimates that two per cent of its sales will not be collected.

- What amount of bad debt expense will be reported on Elliot’s income statement at December 31, 2015?

- What amount of allowance for doubtful accounts will be reported on Elliot’s balance sheet at December 31, 2015?

- Assume Elliot estimates that five per cent of accounts receivable will not be collected.

- What amount of bad debt expense will be reported on Elliot’s income statement at December 31, 2015?

- What amount of allowance for doubtful accounts will be reported on Elliot’s balance sheet at December 31, 2015?

- Which calculation provides better matching: that made in question 1 or in question 2? Why?

- 1762 reads