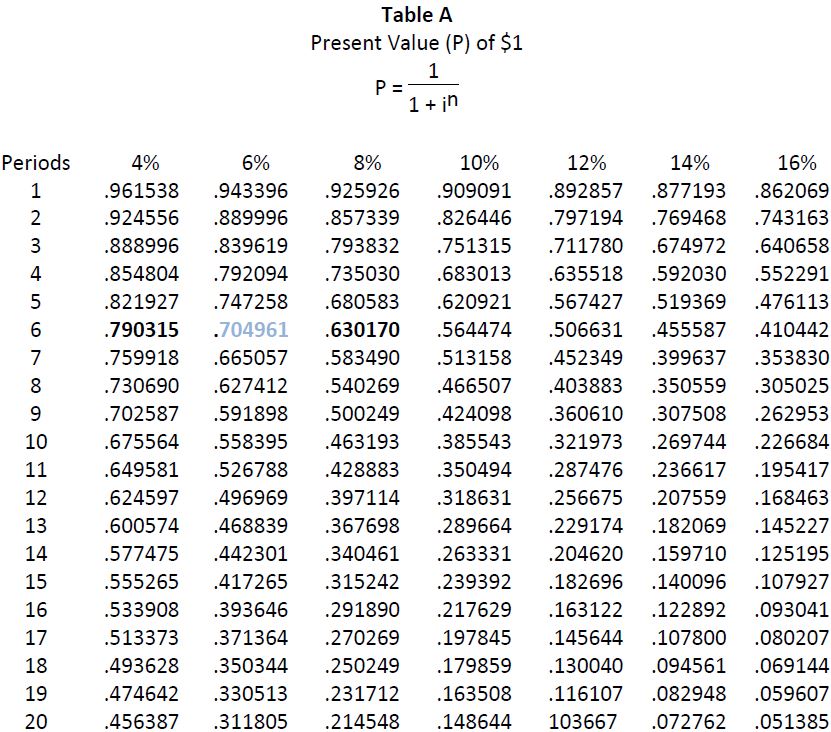

The present value of a single future amount — $100,000 in this case — can be calculated using table A below. Since semi-annual interest payments are made, the 6-month rate is used. This is half the annual rate, or 6% (12% x ½). The “6%” column below is therefore used, rather than the 12% column. Also, because there are 6 interest payment periods over the 3-year life of the bond, the “6 period” row is used instead of the “3 period” row. The intersection of this row and column is $.704961 (see amount in blue in the table). This represents the present value of $1 to be received six periods hence, assuming an interest rate of 6% per period.

Scenario 1: The Bond Contract Interest Rate (12%) Is the Same as theMarket Interest Rate (12%)

The present value of $100,000 principal to be received three years from now is $100,000 x 0.704961 = $70,496.

Scenario 2: The Market Interest Rate Is 8% (per Year)

Again, since semi-annual interest payments are made, the 6-month rate is half the annual rate. Therefore, the compounding rate this time is 4% (8% x ½); there are 6 periods of interest payments.

According to table A, the present value of $1 compounded at 4% for 6 periods is 0.790315 (see bolded amount in 4% column). The present value of the principal amount of the bonds is therefore calculated as: $100,000 x 0.790315 = $79,032.

Scenario 3: The Market Interest Rate Is 16% (per Year)

For these semi-annual interest payments, the 6-month rate is 8% (16% x ½); there are also 6 periods of interest payments.

According to table A, the present value of $1 compounded at 8% for 6 periods is 0.630170 (see bolded amount in 8% column). The present value of the principal amount of the bonds is therefore calculated as: $100,000 x 0.630170 = $63,017.

- 1969 reads