| LO3 – Record and disclose preferred and common share transactions including share splits. |

Shares have a stated or nominal value—the amount for which they are issued. Alternatively, but rarely, shares will have a par-value which is the amount stated in the corporate charter below which shares cannot be sold upon initial offering. For consistency, we will assume all shares have a stated value.

To demonstrate the issuance and financial statement presentation of shares, assume that New World Corporation is authorized to issue share capital consisting of an unlimited number of voting common shares and 100,000 non-voting preferred shares.

Transaction 1: On January 1, 2015, New World sells 1,000 common shares to its first shareholders for $10 per share, or $10,000 cash.

New World would record the following entry:

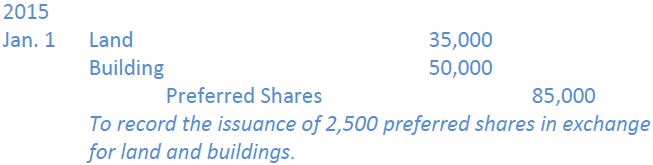

Transaction 2: On February 1, 2015, 2,500 preferred shares are issued to the owner of land and buildings that have a fair value of $35,000 and $50,000, respectively. The journal entry to record this transaction is:

Usually, one or more individuals decide to form a corporation. Before the corporation is created, they may use their own funds to pay for legal and government fees, travel and promotional costs, and so on. When the corporation is legally formed, it is not unusual for the corporation to issue shares to these organizers for these amounts. These start-up expenditures are referred to as organization costs and are usually expensed unless they are a large amount, in which case they are capitalized.

Transaction 3: On March 1, 2015, 500 common shares are issued to the organizers of New World to pay for their services, valued at $5,000. The journal entry to record this transaction is:

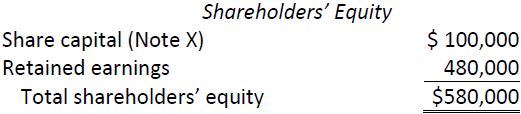

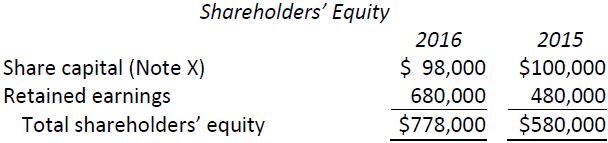

Assuming no further share transactions, and net income of $480,000 earned during the first year of operations, the shareholders’ equity section of the New World Corporation balance sheet would show the following at December 31, 2015:

The relevant note to the financial statements would state:

Note X

The authorized share capital of New World Corporation consists of an unlimited number of no par-value shares and 100,000 no par-value, non-voting preferred shares. Preferred shares take precedence when dividends are declared and upon repayment of capital. Common shares represent one vote each at shareholders’ meetings of New World Corporation.

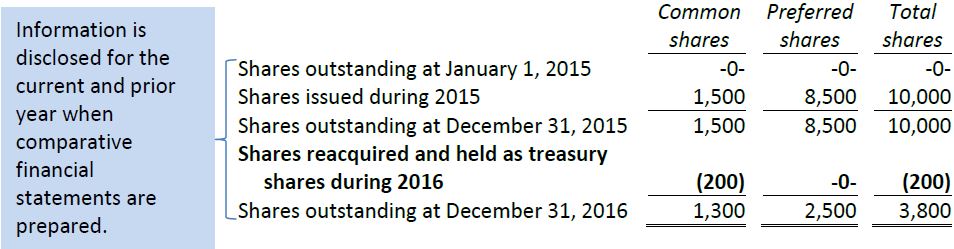

During the year, 1,500 common shares were issued to founding shareholders for a stated value of $10 per share. This represented 100% of total common shares issued. 2,500 preferred shares were issued for a stated value of $34 per share in consideration for land and buildings used in the company’s operations. This represented 100% of total preferred shares issued. Information related to number of shares outstanding is as follows:

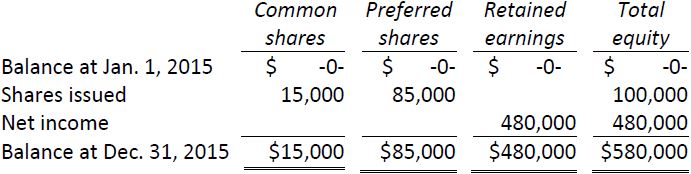

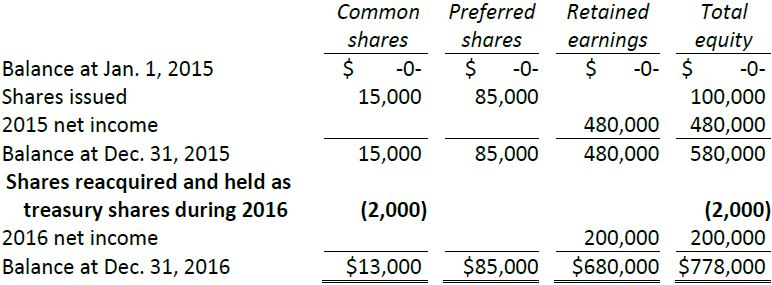

The statement of changes in equity would show:

Transaction 4: Corporate legislation permits a company to reacquire some of its shares, provided that the purchase does not cause insolvency. A company can repurchase and then cancel the repurchased shares. When repurchased shares are cancelled, they are no longer issued and no longer outstanding. A company can also repurchase shares and then hold them in treasury. Treasury shares are issued but not outstanding. A company can use treasury shares for purposes such as giving to employees as an incentive or bonus.

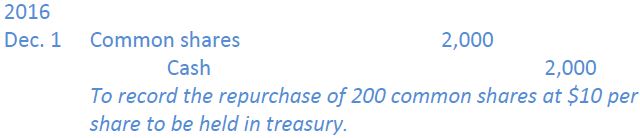

Assume that New World Corporation decides to repurchase 200 common shares on December 1, 2016 and hold them in treasury. Assume that the price of each share is the average issue price of the outstanding common shares, or $10. The journal entry to record the repurchase is:

Assuming 2016 net income of $200,000 and no further transactions, the shareholders’ equity section of the New World Corporation balance sheet would show the following at December 31, 2016:

The relevant note to the financial statements would state:

Note X

The authorized share capital of New World Corporation consists of an unlimited number of no par-value shares and 100,000 no par-value, non-voting preferred shares. Preferred shares take precedence when dividends are declared and upon repayment of capital. Common shares represent one vote each at shareholders’ meetings of New World Corporation.

During the year, 200 common shares with a stated value of $10 per share were repurchased by the corporation and are held as treasury shares. This represents 13.3% of common shares issued as of December 31, 2016. Information related to number of shares outstanding is as follows (bolded for illustration purposes):

The statement of changes in equity would show (bolded for illustrative purposes):

Notice that the repurchase of shares caused a decrease in both the total stated capital of the common shares ($2,000 decrease) and in the number of shares outstanding (decreased by 200 shares).

- 4170 reads