A bond is sold at a premium when it is sold for more than its face value. This usually results when the bond interest rate is higher than the market interest rate at the date of issue.

For instance, assume Big Dog Carworks Corp. issues a bond on January 1, 2015 with a face value of $1,000, a maturity date of one year, and a stated interest rate of 8% per year, at a time when bonds with similar terms, features, and risk are earning only a 7% return. Potential investors will bid up the bond price on the bond market to the point at which the price paid will equal the interest and return of the original investment at the end of the year as if the bond actually yielded 7%. This works out to about $1,009 because an investor who buys the 8% bonds will receive $80 ($1,000 x 8%) interest plus the original $1,000 investment back at December 31, 2018, for a total of $1,080. The amount that would need to be invested at the market rate of 7% to return back $1,080 at the end of one year would be about $1,009 ($1,080/1.07). The price of the 8% bond will be bid up to this price.

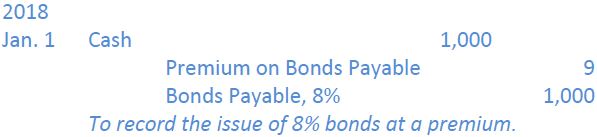

The difference between the selling price of the bond ($1,009) and the face value ($1,000) is the premium of $9. The journal entry to record the sale of the bond is:

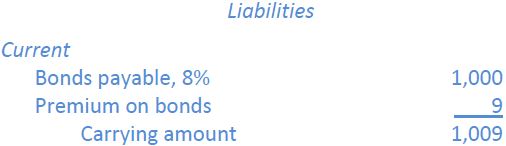

Because the bonds mature in one year, the $9 amount is added to the value of the bonds and recorded in the current liabilities section of the balance sheet. The net amount is referred to as the bond carrying amount. The balance sheet just before the bond redemption would show:

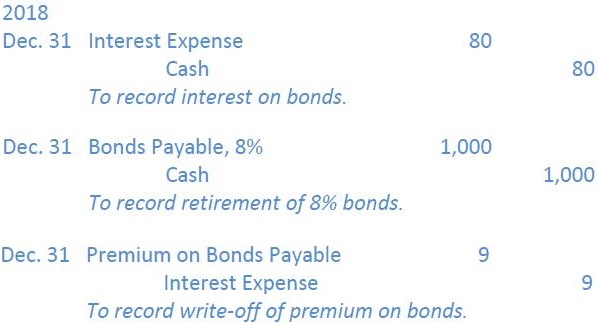

On December 31, 2018, the interest expense of $80 is paid, the bond matures, bondholders are repaid, and the premium is written off as a reduction of interest expense.

These three journal entries would be made:

Note that the interest expense recorded on the income statement would be $71 ($80 – 9) or about 7% (rounded). This is equal to the market rate of interest at the time of bond issue.

If the bond is sold for less than $1,000, then the bond has been sold at a discount. This usually results when the bond interest rate is lower than the market interest rate.

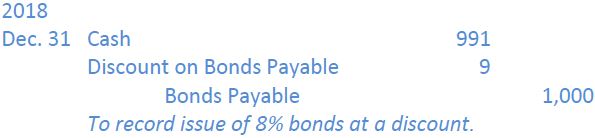

Assume now that the same $1,000, one-year, 8% bond is issued by BDCC. If similar bonds are earning a return of 9% at the date of issue, the selling price of the bond will fall on the market until the point at which the amount of interest to be paid at the end of 2018 ($80) plus the original $1,000 investment produces a return of 9% to the bonds’ purchasers. This selling amount will be about $991 ($1,080/1.09). The difference between the face value of the bond ($1,000) and the selling price of the bond ($991) is $9. This is the discount.

The journal entry to record the transaction on January 1, 2018 is:

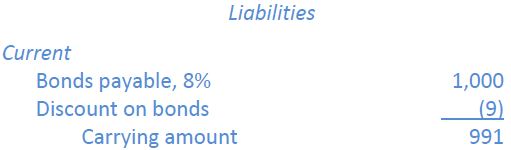

The $9 amount is a contra liability account and is deducted from to the value of the bonds recorded in the current liabilities section of the balance sheet just before the bond redemption would show:

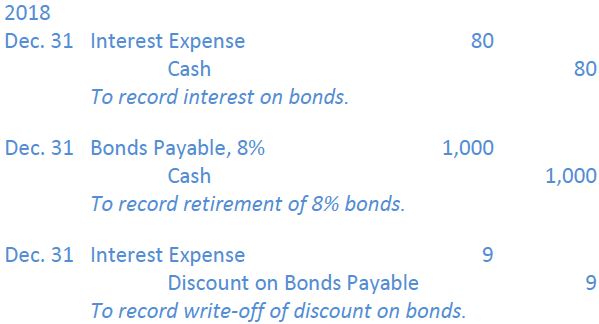

These three journal entries would be made on December 31, 2018:

The interest expense recorded on the income statement would be $89 ($80 + 9) or about 9% (rounded). This is equal to the market rate of interest at the time of bond issue.

These are simplified examples, and the amounts of bond premiums and discounts are insignificant. In reality, bonds may be issued partway through a fiscal year and may be outstanding for a number of years. Related premiums and discounts can be significant when millions of dollars of bonds are issued and these amounts need to be reduced systematically over the life of a bond issue. Accounting for these considerations is discussed below.

- 2277 reads