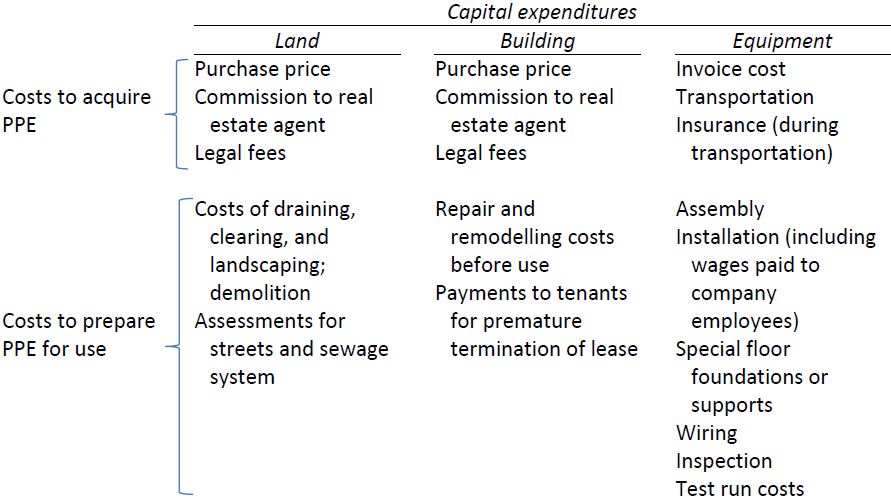

Any cash disbursement is referred to as an expenditure. A capital expenditure results in the acquisition of a non-current asset, including any additional costs involved in preparing the asset for its intended use. Examples of various costs that may be incurred to prepare PPE for use are listed below.

To demonstrate, assume that equipment is purchased for $20,000. Additional costs include transportation costs $500, installation costs $1,000, construction costs for a cement foundation $2,500, and test run(s) costs to debug the equipment $2,000. The total capitalized cost of the asset to put it into use is $26,000.

Determining whether an outlay is a capital expenditure or a revenueexpenditure is a matter of judgment. A revenue expenditure does not have a future benefit beyond one year. The concept of materiality enters into the distinction between capital and revenue expenditures. As a matter of expediency, an expenditure of $20 that has all the characteristics of a capital expenditure would probably be expensed rather than capitalized, because the time and effort required by accounting staff to capitalize and then depreciate the item over its estimated useful life is much greater than the benefits derived from doing so. Capitalization policies are established by many companies to resolve the problem of distinguishing between capital and revenue expenditures. For example, one company’s capitalization policy may state that all capital expenditures equal to or greater than $1,000 will capitalized, while all capital expenditures under $1,000 will be expensed when incurred. Another company may have a capitalization policy limit of $500.

Not all asset-related expenditures incurred after the purchase of an asset are capitalized. An expenditure made to maintain PPE in satisfactory working order is a revenue expenditure and recorded as a debit to an expense account. Examples of these expenditures include: (a) the cost of replacing small parts of an asset that normally wear out (in the case of a truck, for example: new tires, new muffler, new battery); (b) continuing expenditures for maintaining the asset in good working order (for example, oil changes, antifreeze, transmission fluid changes); and (c) costs of renewing structural parts of an asset (for example, repairs of collision damage, repair or replacement of rusted parts).

Although some expenditures for repair and maintenance may benefit more than one accounting period, they may not be material in amount or they may have uncertain future benefits. They are therefore treated as expenses. These three criteria must all be met for an expenditure to be considered capital in nature.

- Will it benefit more than one accounting period?

- Will it enhance the service potential of the asset, or make it more valuable or more adaptable?

- Is the dollar amount material?

If the expenditure does not meet all three criteria, then it is a revenue expenditure and is expensed.

- 4406 reads