Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

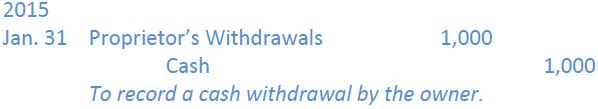

A corporation distributes a portion of income earned to shareholders in the form of dividends. In a proprietorship, the owner distributes a portion of the business’s income in the form of withdrawals and these are recorded as debits to the Proprietor’s Withdrawals account. At year-end, this account is closed to Proprietor’s Capital account. A typical journal entry to record a cash withdrawal would be:

- 2033 reads