| LO6 – Account for the liquidation of a partnership. |

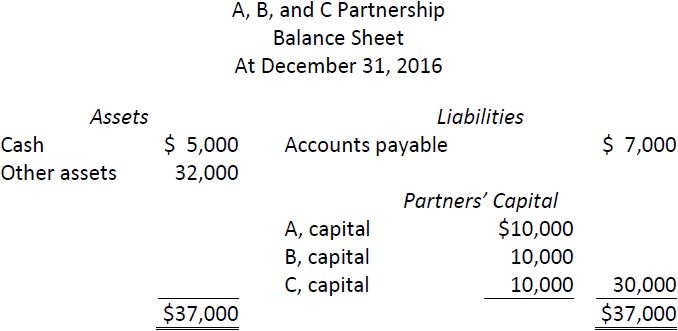

The liquidation of a partnership results in a termination of the partnership business. Its assets are sold, debts are paid, and any remaining cash or unsold assets are distributed to the partners in settlement of their capital balances. The amount of cash available to partners depends on the amount of proceeds from the sale of partnership assets after liabilities have been paid. The following partnership post–closing balance sheet at December 31, 2016 will be used to illustrate the accounting for the liquidation of A, B, and C Partnership.

For purposes of this section, profits and losses are assumed to be shared in a ratio of 5:3:2 (A: 50%; B: 30%; 20%). All the following transactions take place on January 1, 2017.

- 3368 reads