A weighted average cost flow is assumed when goods purchased on different dates are mixed with each other. The weighted average cost assumption is popular in practice because it is easy to calculate. It is also suitable when inventory is held in common storage facilities—for example, when several crude oil shipments are stored in one large holding tank. To calculate a weighted average, the total cost of all purchases of a particular inventory type is divided by the number of units purchased.

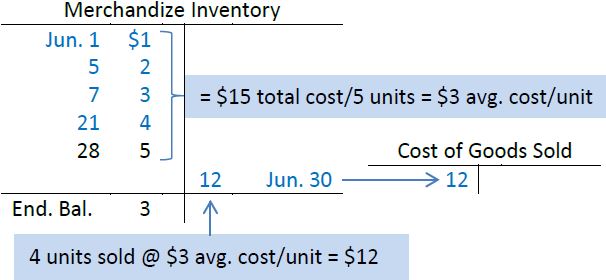

To calculate the weighted average cost in our example, the purchase prices for all five units are totalled ($1 + $2 + $3 + $4 + $5 = $15) and divided by the total number of units purchased (5). The weighted average cost for each unit is $3 ($15/5). The weighted average cost of goods sold would be $12 (4 units @ $3). Sales still equal $40 resulting in a gross profit under weighted average of $28 ($40 – $12). The cost of the one remaining unit in ending inventory is $3.

The general ledger T-accounts for Merchandize Inventory and Cost of Goods Sold are:

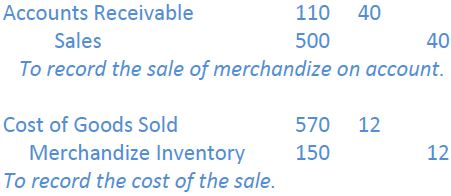

The entry to record the sale would be:

- 7569 reads