Since the time and effort devoted by individual partners to the business is often unequal and the amount of capital balance varies among partners, other allocation method may be used. Profits and losses can be allocated by interest on partners’ capital balances and salaries to partners to each partner, in accordance with individual contributions. Any remaining profits and losses can be divided through the profit and loss sharing ratio. It is important to understand that the salary and interest allocations are not deducted as expenses on the income statement; salary and interest used here refer only to individual factors used in dividing profits and losses among partners.

To illustrate: Before beginning their partnership, A and B agreed that 12 per cent interest would be allocated to their capital balances and that A deserved more compensation because of his valuable technical skills. Accordingly, allocation of profit was also to be based on salaries of $7,000 to A and $5,000 to B. They also agreed that any remaining profit and loss should be shared in the ratio of 3:2.

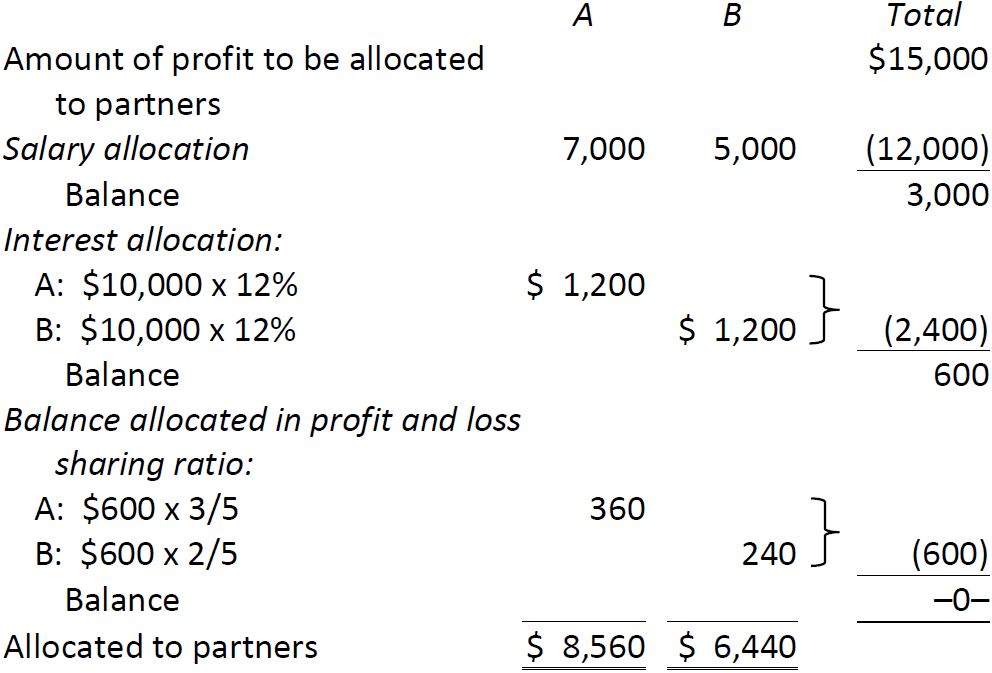

Assume A and B have each contributed $10,000 to the partnership, and that net income for the year is $15,000. The net income would be allocated as follows:

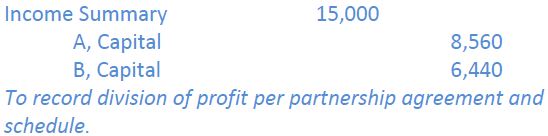

The following entry records this profit allocation between A and B:

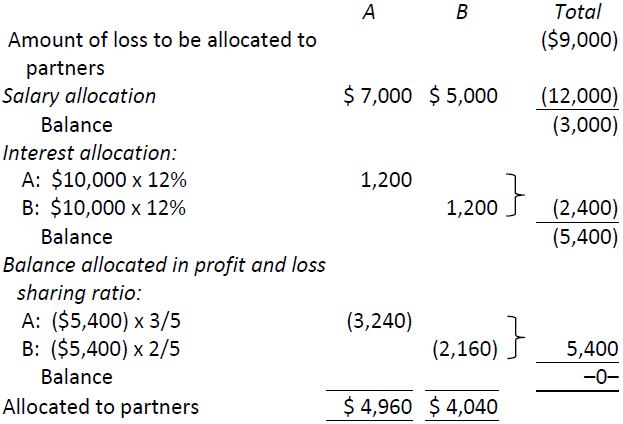

If the $15,000 partnership income had been inadequate to cover the salary and interest allocated to A and B, the difference would have been allocated in the profit and loss sharing ratio. Assuming that partnership net income had amounted to $9,000, the following calculation of amounts allocated to the partners would be made:

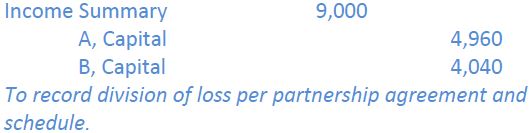

The journal entry to allocate the loss would be:

- 6484 reads