| LO5 – Calculate cost of goods sold and merchandize inventory under specific identification, first-in first-out (FIFO), and weighted average cost flow assumptions, using the periodic inventory system. |

Recall from Chapter 5 that the periodic inventory system does not maintain detailed records to calculate cost of goods sold each time a sale is made. Rather, when a sale is made, the following entry is made:

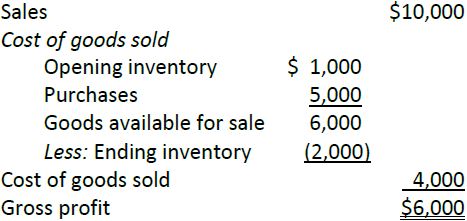

No entry is made to record cost of goods sold and to reduce Merchandize Inventory, as is done under the perpetual inventory system. Instead, all purchases are expenses and recorded in the general ledger account “Purchases.” A physical inventory count is conducted at year-end. An amount for ending inventory is calculated based on this count and the valuation of the items in inventory, and cost of goods sold is calculated in the income statement based on this total amount. The income statement format is:

Even under the periodic inventory system, however, inventory cost flow assumptions need to be made (specific identification, FIFO, weighted average) when purchase prices change over time, as in a period of inflation. Further, different inventory cost flow assumptions produce different cost of goods sold and ending inventory values, just as they did under the perpetual inventory system. These effects have been explained earlier in this chapter. Under the periodic inventorysystem, cost of goods sold and ending inventory values are determinedas if the sales for the period all take place at the end of the period.These calculations were demonstrated in our earliest example in this chapter.

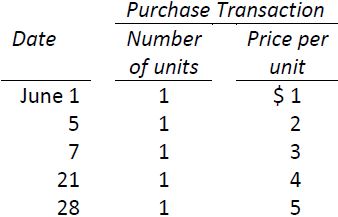

Our original example using units assumed there was no opening inventory at June 1, 2015 and that purchases were made as follows.

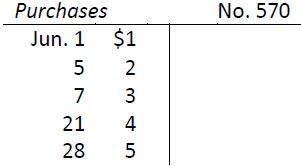

When recorded in the general ledger T-account “Purchases” (an income statement account), these transactions would be recorded as follows:

Sales of four units are all assumed to take place on June 30. Ending inventory would then be counted at the end of the day on June 30. One unit should be on hand. It would be valued as follows under the various inventory cost flow assumptions, as discussed in the first part of the chapter:

|

Specific identification |

$4 |

|

FIFO |

5 |

|

Weighted average |

3 |

These values would be used to calculate cost of goods sold and gross profit on the income statement, as shown in Figure 6.16 below:

Note that these results are the same as those calculated using the perpetual inventory system and assuming all sales take place on June 30 using specific identification (Figure 6.2), FIFO (Figure 6.3), and weighted average (Figure 6.4) cost flow assumptions, respectively.

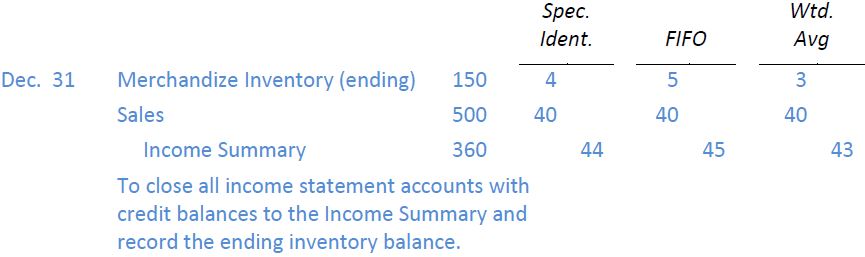

As discussed in the appendix to Chapter 5, the ending inventory amount will be recorded in the accounting records when the income statement accounts are closed to the Income Summary general ledger account at the end of the year. The amount of the closing entry for ending inventory is obtained from the income statement. Using the example above and assuming no other revenue or expense items, the closing entries to adjust ending inventory to actual under the each inventory cost flow assumption would be as follows.

Entry 1

- 2943 reads